Forex Trading for Beginners 2

What is Forex Analysis and How does it work?

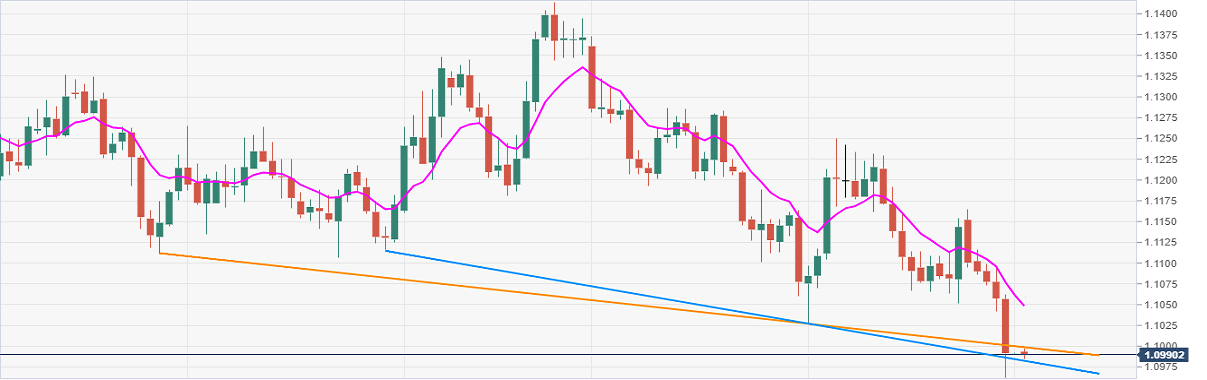

Forex Technical Analysis

Forex Technical analysis believe that prices trend directionally: up, down, or sideways or some combination. The basic definition of a price trend was originally put forward by Dow theory. Technical analysis believe that investors collectively repeat the behavior of the investors that preceded them. To a technician, the emotions in the market may be irrational, but they exist. Because investor behavior repeats itself so often, technicians believe that recognizable and predictable price patterns will develop on a chart. Recognition of these patterns can allow the technician to select trades that have a higher probability of success.

Forex Fundamental Analysis

Fundamental analysis is performed on historical and present data, but with the goal of making financial forecasts. Fundamental analysis, in accounting and finance, is the analysis of a business's financial statements usually to analyze the business's assets, liabilities, earnings and competitors and markets. It also considers the overall state of the economy and factors including interest rates, production, earnings, employment, GDP, housing, manufacturing and management. There are two basic approaches that can be used: bottom up analysis and top down analysis. These terms are used to distinguish such analysis from other types of investment analysis, such as quantitative and technical. Fundamental analysis is one of the most time-consuming forms of analysis.

Forex Fundamental Analysis includes: economic analysis, industry analysis, company analysis. The real value of the shares is determined based upon these three analyses. It is this value that is considered the true value of the share. If the intrinsic value is higher than the market price, buying the share is recommended. If it is equal to market price, it is recommended to hold the share; and if it is less than the market price, then one should sell the shares.The analysis of a business health starts with a financial statement analysis that includes financial ratios. It looks at dividends paid, operating cash flow, new equity issues and capital financing.

Forex Technical Analysis & Forex Fundamental Analysis

Technical analysis stands in contrast to the fundamental analysis approach to security and stock analysis. Technical analysis is the examination of multiple. Multiple encompasses the psychology generally abounding, i.e. the extent of willingness to Buy or Sell. Technical analysis analyzes price, volume, psychology, money flow and other market information, whereas fundamental analysis looks at the facts of the company, market, currency or commodity. Most large brokerages, trading groups, or financial institutions will typically have both a technical analysis and fundamental analysis team.

Why are Forex Reviews is important?

As a person looking for new solutions and options in the Forex market, you should check out Forex reviews and comments posted by other users. Thanks to the Forex reviews shared on the website you may choose the best Forex solution available on the market. These Forex reviews will help you to make wise decisions and avoid choosing products or services of no real value. If you had any experience in the Forex market it is time for you to share your reviews and help others to choose the best solutions and make the best possible decisions. By registering on our website you can post a forex review on any product or service related to this market. Remember that only honest opinions resulting from actual experiences will be valued by other people who are beginners in this market. As they search for new opportunities and to learn from others? experiences, your reviews will come in very helpful and they will also facilitate the process of investing in an effective and safe manner. If you want to add your opinions, go to the Forex Reviews section and select one of the categories. We also recommend that you review the scam sections where we have managed to uncover several scams. Please do share your experiences and encourage others to do so, so that we can help one another!