Forex Trading for Beginners 1

What is Forex Trading and How does it work?

What is a Forex and How does it work?

The foreign exchange market is unique because of the following characteristics:

- big trading volume

- small deposit for start

- 24 hours a day except for weekends

- the variety of factors that affect exchange rates

- the use of leverage to enhance profit and loss margins

- the low margins of relative profit compared with other markets

According to the Bank for International Settlements, the preliminary global results from the 2019 Triennial Central Bank Survey of Foreign Exchange and OTC Derivatives Markets Activity show that trading in foreign exchange markets averaged $6.6 trillion per day in April 2019. This is up from $5.1 trillion in April 2016. Measured by value, foreign exchange swaps were traded more than any other instrument in April 2019, at $3.2 trillion per day, followed by spot trading at $2 trillion.

What is a Forex Broker and How does it work?

There are 3 types of forex brokers:

Check ECN Broker

Check MM broker

Check STP broker

ECN means Electronic Communications Network (it is a network) Within this network the broker collects the prices of several liquidity providers such as banks, or financial institutions and always selects the best prices to offer them to its customers. Broker ECN offers real market conditions offering its customers the possibility of operating under the same conditions as banks and other large companies. Spread are lower offering Market Makers or STP brokers. There are no conflicts of interest with its customers. Transactions in ECN are performed as instant execution, that is, without any delay.

Market Maker are the brokers that create their own markets and conditions, which means that prices do not enter directly from banks etc. Virtually every 1 of 3 brokers is Market Maker. They offer spreads a little higher than ECN or STP.

STP is by Straight Trough Processing. They work more or less like ECN, sending all transactions directly to the market. STP brokers always increase the spreads offered by liquidity providers and this is their benefit. There are no conflicts of interest with its customers. STP brokers offer to carry out transactions as Instant execution, without any delay. Operations always go to the foreign exchange market, liquidity providers, banks or financial institutions.

What is a Trading platform and How does it work?

In finance trading platform also known as an online trading platform, is a computer software program that can be used to place orders for financial products over a network with a financial intermediary. Various financial products can be traded by the trading platform, over a communication network with a financial intermediary or directly between the participants or members of the trading platform. This includes products such as stocks, bonds, currencies, commodities, derivatives and others, with a financial intermediary, such as brokers, market makers, Investment banks or stock exchanges. Such platforms allow electronic trading to be carried out by users from any location and are in contrast to traditional floor trading using open outcry and telephone based trading.

Trading platforms typically stream live market prices on which users can trade and may provide additional trading tools, such as charting packages, news feeds and account management functions. Some platforms have been specifically designed to allow individuals to gain access to financial markets that could formerly only be accessed by specialist trading firms. They may also be designed to automatically trade specific strategies based on technical analysis or fundamental analysis. The most popular trading plataforms: MetaTrader 4, MetaTrader 5, cTrader, NinjaTrader, Currenex.

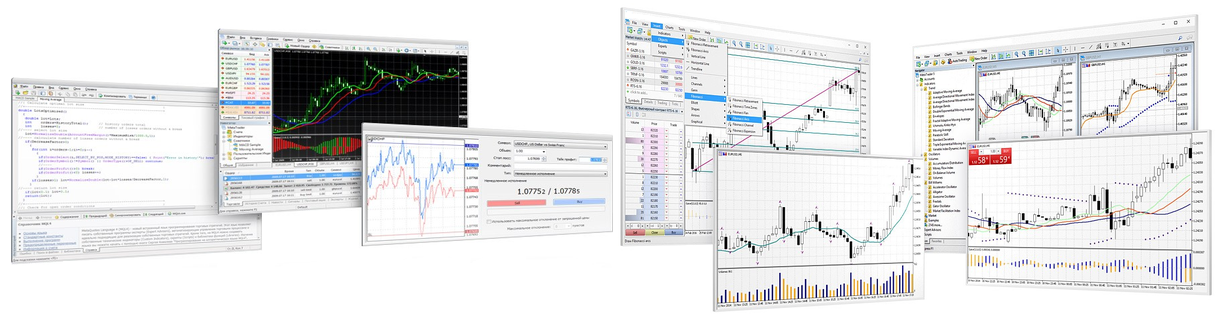

The MetaTrader 4 and MetaTrader 5 trading platforms is designed for forex and futures trading. With MetaTrader 4 and MetaTrader 5, clients can analyze financial markets, perform advanced trading operations, use robots (Experts Advisors - EA). MetaTrader 4 nd MetaTrader 5 is the most popular forex trading platforms in the world as it offers an easy to use user interface, various charts and indicators, EAs and most importantly the MQL language that allows the user to program their own strategies.The platform provides an easy-to-use interface to help you easily understand all the functions and principles of operation. It will only take a few minutes to get started with the platform.The MetaTrader 4 nd MetaTrader 5 platforms meets the highest security standards. The data exchange between the client terminal and the platform servers is encrypted. The platform also supports the use of RSA digital signatures. You can be sure that your accounts are safely protected.

System Requirements: Windows Vista, Windows 7-8-10. It is also possible to run MT4/MT5 on MAC. Language support: Bulgarian, Chinese, Czech, Danish, Dutch, English, Finnish, French, German, Hungarian, Italian, Japanese, Korean, Lithuanian, Norwegian, Polish, Portuguese, Romanian, Russian, Slovak, Slovenian, Spanish, Swedish, Russian.

Why are Forex Reviews is important?

As a person looking for new solutions and options in the Forex market, you should check out Forex reviews and comments posted by other users. Thanks to the Forex reviews shared on the website you may choose the best Forex solution available on the market. These Forex reviews will help you to make wise decisions and avoid choosing products or services of no real value. If you had any experience in the Forex market it is time for you to share your reviews and help others to choose the best solutions and make the best possible decisions. By registering on our website you can post a forex review on any product or service related to this market. Remember that only honest opinions resulting from actual experiences will be valued by other people who are beginners in this market. As they search for new opportunities and to learn from others? experiences, your reviews will come in very helpful and they will also facilitate the process of investing in an effective and safe manner. If you want to add your opinions, go to the Forex Reviews section and select one of the categories. We also recommend that you review the scam sections where we have managed to uncover several scams. Please do share your experiences and encourage others to do so, so that we can help one another!