EUR/USD sticks to gains, still below 1.0600

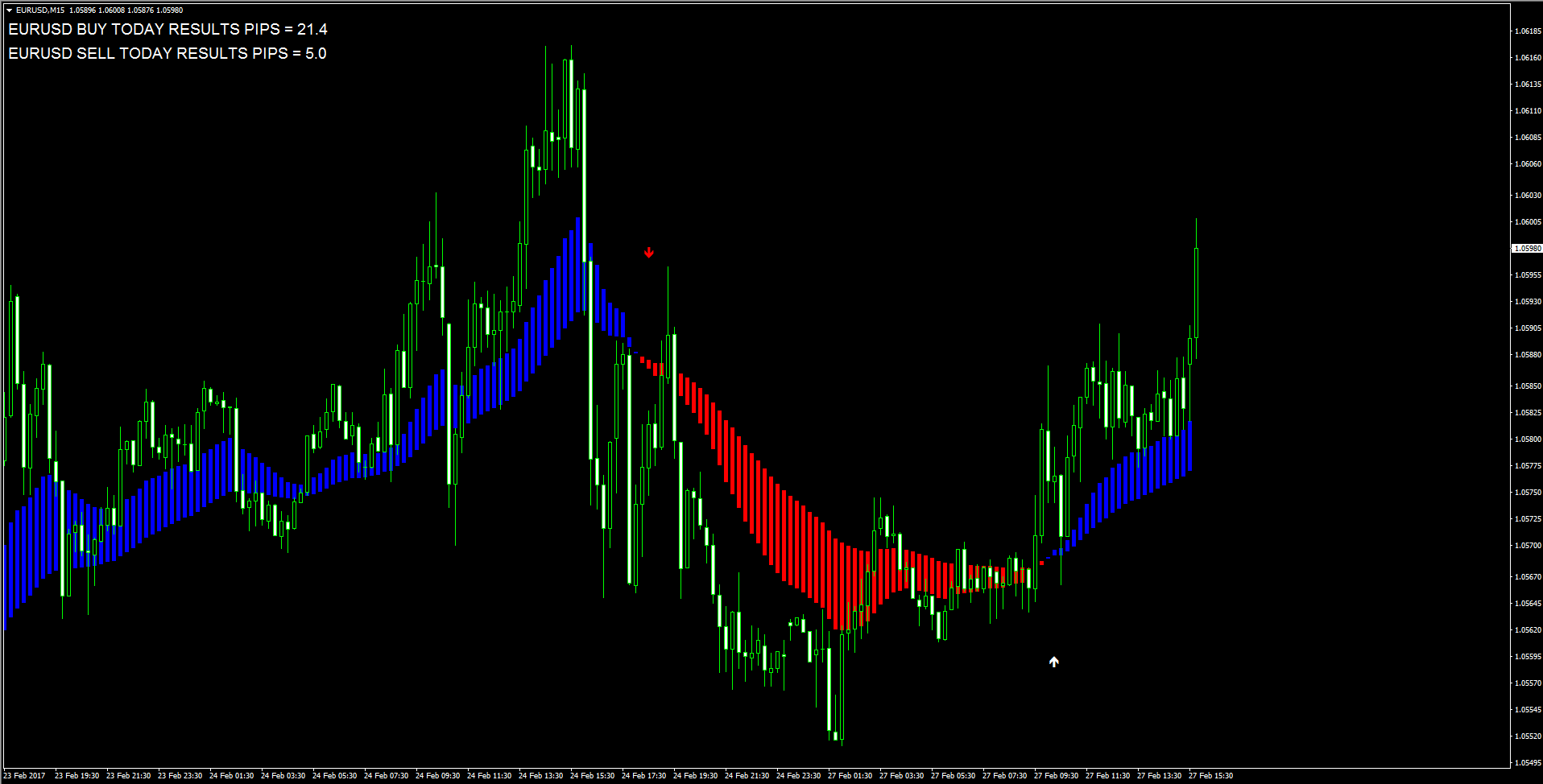

EUR/USD stays on a firm note at the beginning of the week, testing highs in the upper-1.0500s although another test of the 1.0600 barrier still remains absent.Spot has recovered from last Friday?s losses and is currently looking to extend the bounce off last week?s lows in sub-1.0500 levels (last seen in early January), always backed by a renewed albeit mild offered bias around the buck.EUR keeps looking to the upcoming French elections as a political driver for the sentiment in the near term, with recent election polls showing far-right candidate Marine Le Pen leading with 26% of the vote intention in the first round, although she would lose in a second round.In the data space, advanced inflation figures in the euro region for the month of February appear as the salient event this week, particularly in light of the recent pick up in prices, while speeches by President Trump (Tuesday) and Chief Yellen (Friday) should keep the buck in centre stage.From the speculative community, EUR stays under pressure, as net shorts have climbed to 5-week tops in the week to February 21 according to the latest CFTC report.Data wise today, advanced Spanish inflation figures expect the CPI to rise at an annualized 3.0% in February, a tad below estimates. Further data saw Private Loans expanding 2.2% YoY in January and M3 Money Supply rising 4.9% YoY during the same period.Across the pond, Pending Home Sales, Durable Goods Orders and the Dallas Fed index should keep the attention on the buck along with the speech by Dallas Fed R.Kaplan (voter, hawkish).At the moment the pair is up 0.21% at 1.0583 facing the initial hurdle at 1.0592 (55-day sma) followed by 1.0620 (high Feb.24) and finally 1.0651 (20-day sma). On the flip side, a breach of 1.0492 (low Feb.22) would target 1.0452 (low Jan.11) en route to 1.0339 (2017 low Jan.3)

GBP/USD puts 1.2400 under pressure, US data eyed

GBP/USD remains entrenched into the negative territory on Monday, gyrating around the 1.2400 key support ahead of US releases.The Sterling has been under increasing selling pressure since the beginning of the Asian session following news that Scotland could call for second independence referendum.Despite the UK government has later talked down that possibility, the rumours seem to have been enough to prompt Brexit fears to re-emerge and thus drag GBP to fresh 2-week lows vs. the buck.Nothing scheduled today in the UK docket, while market participants should start to focus on the speech by President D.Trump (Tuesday) as the immediate event risk for the pair.Today?s data across the pond include Pending Home Sales, Durable Goods Orders and the Dallas Fed index along with the speech by Dallas Fed R.Kaplan (voter, hawkish).On the positioning front, GBP stayed under pressure during the week ended on February 21, as speculative net shorts have increased to the highest level since mid-December.As of writing the pair is losing 0.42% at 1.2410 and a break below 1.2385 (low Feb.27) would aim for 1.2379 (low Feb.15) and finally 1.2344 (low Feb.7). On the upside, the next resistance lines up at 1.2498 (20-day sma) followed by 1.2571 (high Feb.24) and then 1.2585 (high Feb.9).

USD/JPY room for a test of 111.55/60 UOB

In opinion of FX Strategists at UOB Group, USD/JPY could slip back towards the 111.60/55 band in the near term.?The anticipated USD weakness exceeded our expectation by easily moving below the 112.30 target to hit a low of 111.91. The decline is severely over-extended but in view of the sharp drop, any rebound from here is likely to be limited. Overall, USD is expected to consolidate its loss and trade sideways at these lower levels, probably between 111.90 and 112.60?.?While we indicated that a test of 112.30 would not be surprising, the ease of which this strong support was taken out was unexpected (low of 111.91 on Friday). The pressure is still on the downside and there is room for the current weakness to extend lower towards the major 111.55/60 support (low seen earlier this month). Stabilization is only upon a move back above 113.00?.

EUR/GBP towards 0.83 - Natixis

Sterling recovered over the course of last week against a US dollar penalised by the absence of news concerning Donald Trump?s programme and a euro penalised by the political risk notes Nordine NAAM, Research Analyst at Natixis.?The British currency also drew strength from some good macroeconomic data, notably the 2% GDP growth recorded in 2016 (vs. 1.7% for the Eurozone in 2016). Finally, the absence of news concerning negotiations with the EU also favoured the currency. However, at the meeting of the European Council scheduled on 9 March, Theresa May could trigger Article 50. It will then take almost 3 months for the European Parliament to validate Brexit.??After that, negotiations will get under way and last 18 months, bearing in mind that it will again take 3 months for the European Parliament to ratify any agreements. While transitional agreements could be negotiated, uncertainties will remain significant, especially this year given the many elections (Netherlands, France, Germany and, in 2018, Italy), as populist parties are on the rise nearly everywhere.? ?In this contest, the European Union cannot afford to cut much slack to the UK. Therefore, while the EUR/GBP could correct temporarily towards 0.83 because of the European political risks, the pair should go on to rebound towards 0.89, bearing in mind 3-month RR 25D are excessively low.?

USD/CAD neutral to bullish short term Scotiabank

Eric Theoret, FX Strategist at Scotiabank, noted the pair?s neutral to bullish outlook in the near term.?OIS are pricing just over 2bpts of BoC tightening over the next 12 months and the 2Y U.S.-Canada yield spread remains elevated above 40bpts around the mid-point of its range from late November. Measures of sentiment are bullish, with Friday?s CFTC data showing a sixth consecutive weekly build in gross CAD longs with a push to levels last seen in April 2014 (middle chart). The net long is at highs not seen since June 2016. Measures of implied CAD volatility are low, and risk reversals suggest a continued moderation in the premium for protection against CAD strength?.?USDCAD is quiet trading around the mid-point of its range from late January, consolidating below its 200 day MA near 1.3150. Momentum indicators are neutral, DMI?s are muted, the ADX is trendless, and short-term MA?s have flattened out. We note the sequence of higher lows from January 31, suggesting near-term support in the mid-1.30 area. Resistance is limited ahead of 1.32?.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.