EUR/USD slammed below mid-1.0500s, Fedspeak in focus

After yesterday's brief pause, the EUR/USD pair resumed with its reversal move from 1.0680 level and tumbled below mid-1.0500s.Currently trading around 1.0535 region, testing multi-day lows, the pair ran through fresh offers on Tuesday amid resurgent US Dollar buying interest against the backdrop of late Monday hawkish comments from the Philadelphia Federal Reserve Bank President Patrick Harker, who supported interest rate-hike move at the Fed's next monetary policy meeting in March. Harker's comments reinforced market expectations for an eventual Fed rate-hike move, sooner-rather-than-later, and lifted the greenback across the board.Meanwhile, the release of flash Euro-zone PMI prints were largely ignored by market participants and failed to provide any immediate respite to the shared currency.Furthermore, possibilities of some stops getting triggered on a sustained break below 1.0575-70 horizontal support could have also collaborated to the pair's downslide during mid-European session.Investors attention on Tuesday would remain glued to the upcoming Fedspeak, due later during the day, ahead of the FOMC meeting minutes on Wednesday.A follow through selling pressure below mid-Feb. lows support near 1.0520 region has the potential to drag the pair to sub-1.0500 level ahead of 1.0455 level (Jan. 11 low). On the upside, support break point near 1.0575-70 area now seems to act as immediate resistance and would be followed by resistance near 1.0600 round figure mark. Any further up-move beyond 1.0600 handle might now be capped at 1.0630-35 region (yesterday's high).

GBP/USD tumbles to lows near 1.2420 on BoE

The British Pound is now intensifying its decline following the BoE?s February Inflation Report, dragging GBP/USD to the vicinity of 1.2420.The pair met further selling pressure after BoE?s MPC member A.Haldane said he is comfortable with a neutral stance on the potential course of interest rates, while he reiterated that monetary policy could move in either direction.Furthermore, MPC member I.McCafferty hinted at the fact that the economy could be closer to full employment than recent figures of wage growth show.Spot remains under pressure amidst a solid performance of the greenback, which found extra legs following comments by FOMC?s P.Harker, opening the door for a rate hike at the March meeting.The House of Lords has started on Monday its 2-day debate of Article 50, which is expected to pass without amendments today.In the US docket, Philly Fed P.Harker (voter, hawkish), Minneapolis Fed N.Kashkari (voter, neutral) and San Francisco Fed J.Williams (2018 voter, neutral) are all due to speak later in the session.As of writing the pair is losing 0.26% at 1.2428 facing the next support at 1.2379 (low Feb.15) ahead of 1.2344 (low Feb.7) and finally 1.2250 (low Jan.19). On the upside, a break above 1.2515 (20-day sma) would open the door to 1.2550 (high Feb.14) and finally 1.2715 (high Feb.2).

USD/JPY interim low at 111.59 Commerzbank

Karen Jones, Head of FICC Technical Analysis at Commerzbank, suggested the pair could have carved and interim low at 111.59.?USD/JPY?s failure at the 55 day ma at 114.98 has been decisive and see the market selloff to its 112.97 uptrend. We view the recent low at 111.59 as an interim low. A close above the 115.62 19th January high is needed to reintroduce scope to key short term resistance offered by the 16 month resistance line at 117.97?. ?Only below 111.59 would introduce scope to the base of the cloud, which lies at 109.92 and, if seen, we look for this to hold (this is also the 50% retracement of the move up from November). However this is not our favoured view - we also note that the recent move lower continues to indicate that this is the end of the corrective move?.

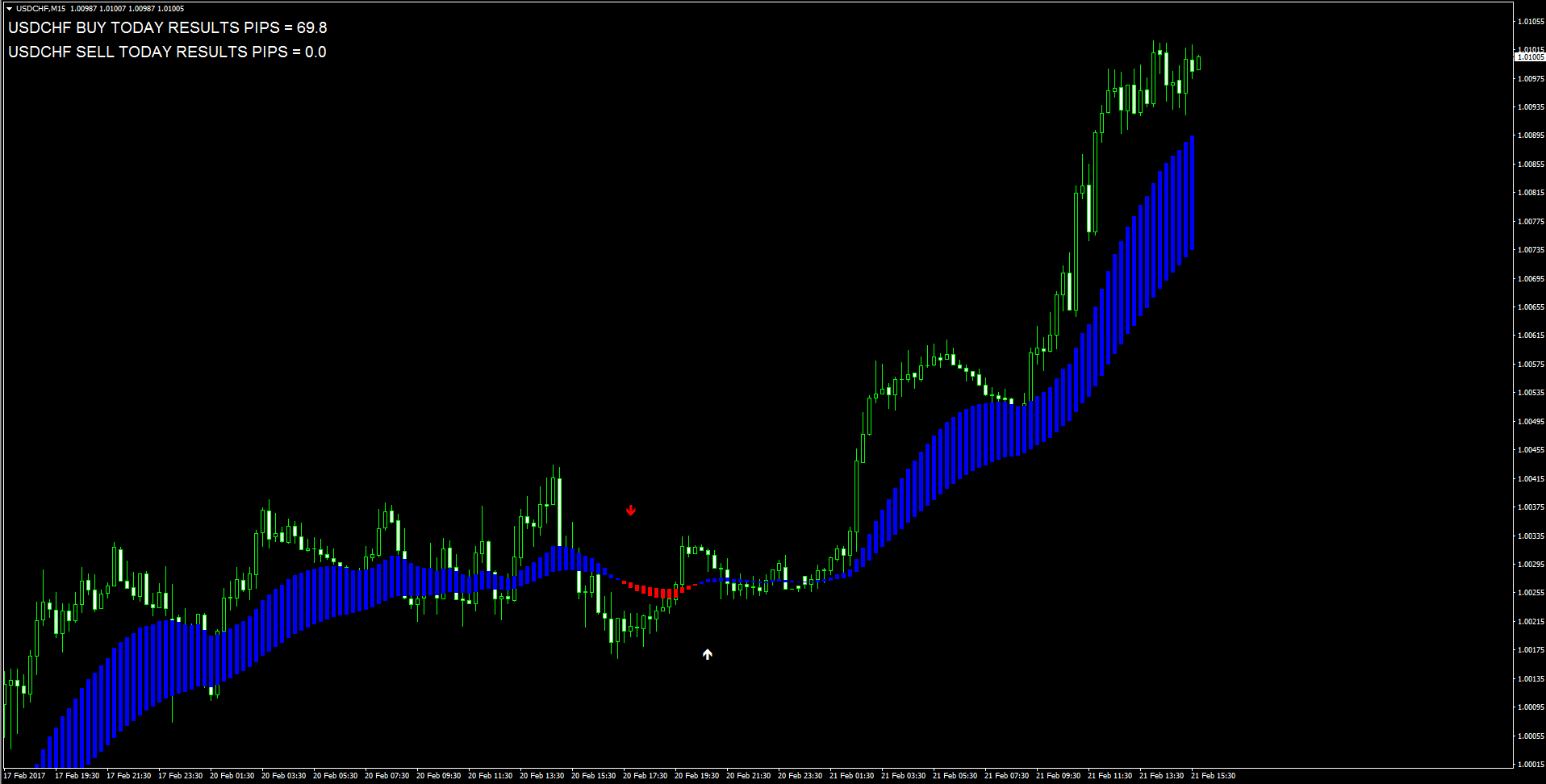

USD/CHF spikes to 1.0100 handle amid notable USD demand

The USD/CHF pair maintained its bid tone for the third consecutive session and inched closer to last week's nearly one-month high level beyond 1.0100 handle.Currently trading just below 1.0100 handle, the pair was seen building on to its move back above 100-day SMA amid resurgent US Dollar buying interest in wake of Monday's hawkish comments from the Philadelphia Federal Reserve Bank President Patrick Harker. Furthermore, the pair's strong up-move through European trading session, despite of upbeat Swiss trade balance data, further seems to reinforce the underlying recovery trend since the beginning of this month from the very important 200-day SMA support.The greenback price dynamics would continue to be an exclusive driver of the pair's near-term movement as market participants now look forward to the Fedspeaks and Wednesday's FOMC meeting minutes. Investors will closely scrutinize the minutes in order to gain some fresh insight over the central bank's near-term monetary policy outlook and gauge timing for the next Fed rate-hike move, which would eventually assist them to determine the next leg of directional move for the major. The ongoing strong bullish momentum now seems to confront resistance near 1.0119 (Feb. 15 high) above which the momentum could get extended towards 1.0170 horizontal resistance, en-route 1.0200 round figure mark. Meanwhile on the downside, 1.0065-60 area now seems to act as immediate support, which if broken might drag the pair back towards 100-day SMA support near 1.0020 region. Only a convincing break below 100-day SMA, leading to a subsequent weakness back below parity mark, would negate any near-term bullish bias and turn the pair vulnerable to resume with its prior depreciating move.

EUR/CHF seen around 1.0700 near term Danske Bank

Jens Pedersen, Senior Analyst at Danske Bank, believes the cross remains poised to stay around the 1.0700 handle in the near term.?Political uncertainty in Europe, coupled with rising geopolitical risks following the election of Donald Trump as the next US president, has supported CHF and put pressure on SNB to act to curb CHF appreciation pressure?.?Political uncertainty looks to be a key theme for FX markets again this year. EUR/CHF is still trading close to 1.07?.?We expect it to stay here in the near term as focus turns to European political uncertainty. Longer term, we continue to expect fundamentals to support a higher EUR/CHF and keep our 6M and 12M forecasts unchanged at 1.10 and 1.13, respectively?.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.