EUR/USD pauses 4-day sell-off, 1.0600 back on sight?

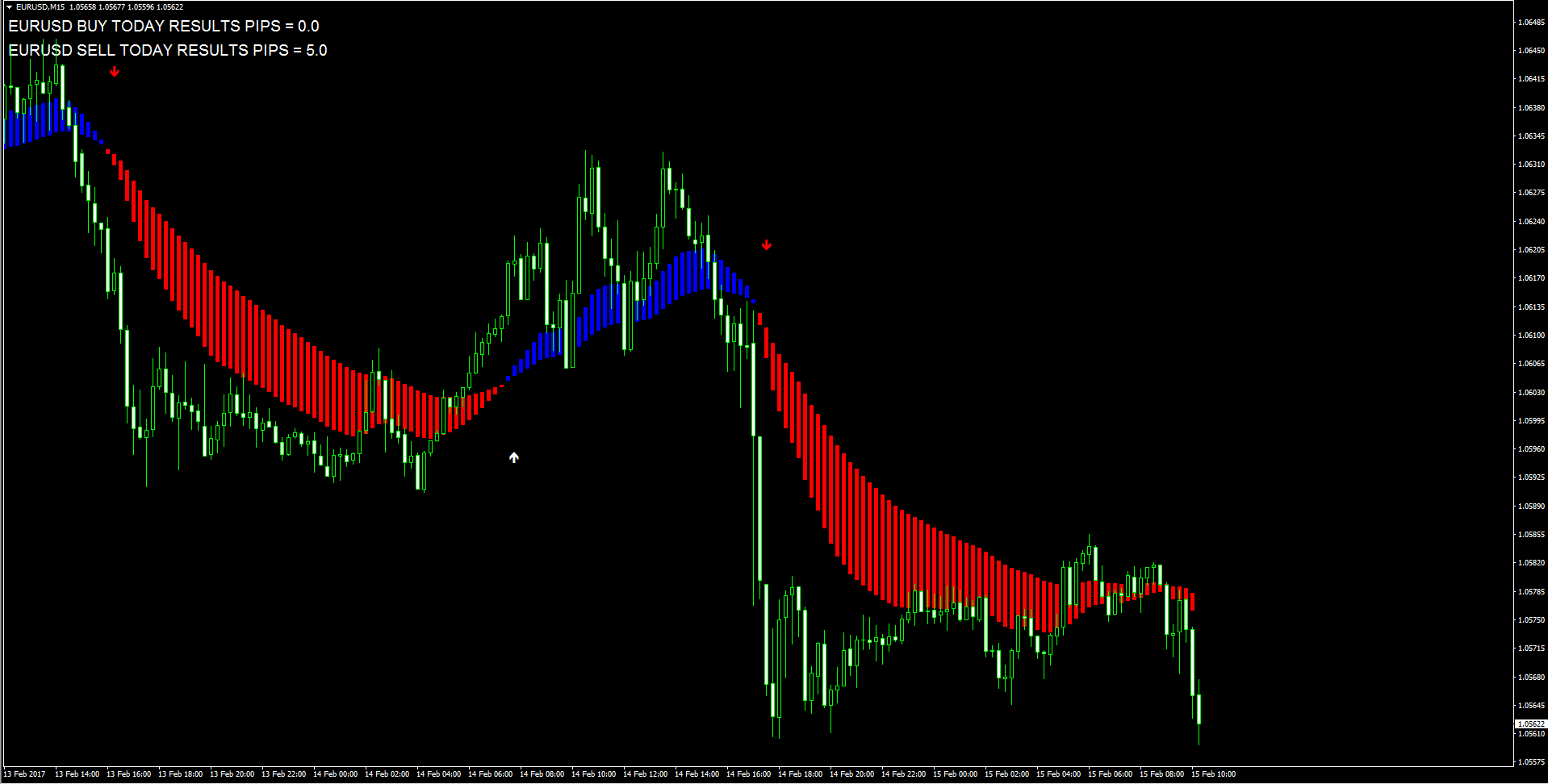

The EUR/USD pair is seen trying hard to sustain the recovery from Yellen?s hawkish testimony-driven sell-off to 1.0560 levels, and now makes headways towards 1.06 handle in early Europe.Currently, the spot now peeks into the green zone at 1.0580, testing session highs posted previously at 1.0587, where the daily pivot resistance intersects. The main currency pair is on a steady recovery path amid a phase of upside consolidation phase in the greenback against its main competitors, as the USD bulls take a breather from yesterday?s extensive rally fuelled by Yellen?s comments that signaled Fed?s growing appetite for monetary policy tightening in the near-term.However, the recovery may lack follow-through as a fresh round of USD buying is expected once the European traders hit their desks and react to yesterday?s testimony delivered by the Fed Chair Yellen before the Senate Banking Committee. While a slew of disappointing macro updates from the Eurozone and Germany released a day earlier continue to undermine the sentiment around the euro.Later today, the spot remains at the mercy of the USD dynamics in wake of a fresh batch of US economic releases and Fedspeaks due on the cards in the NA session. In the meantime, the Eurozone trade balance data is likely to keep the EUR traders busy.In terms of technicals, the pair finds the immediate resistance 1.0602/08 (5 & 50-DMA). A break beyond the last, doors will open for a test of 1.0658 (10-DMA) and from there to 1.0676 (100-DMA). On the flip side, the immediate support is placed at 1.0561 (post-Yellen low) below which 1.0520 (Jan 6 low) and 1.0500 (psychological levels) could be tested.

GBP/USD flat around 1.2470 ahead of UK jobs

After bottoming out near 1.2440 during overnight trade, GBP/USD has managed to regain the 1.2465/70 band ahead of the European open on Wednesday.Disappointing inflation figures on Tuesday plus the hawkish tone from Chairwoman Yellen at her testimony prompted the pair to shed around a cent from tops in the mid-1.2500s to today?s lows in the 1.2445/40 band.In fact, the greenback was largely benefited on Tuesday after Chief J.Yellen delivered a hawkish message at her Humphrey Hawkins Testimony, once again advocating for gradual rate hikes and adding that it would be ?unwise? to wait too long to hike. Yellen?s comments triggered a sell off in the US FI space and fuelled tailwinds for the buck, opening at the same time the door for a rate hike at the March meetingLater in the session, UK?s labour market figures are due, with consensus seeing the jobless rate at 4.8% in December and the Claimant Count Change increasing by a meagre 1K in January.Across the pond, the second testimony by Janet Yellen is due along with inflation figures tracked by the CPI, Retail Sales, the NY Empire State manufacturing index, Industrial Production and the NAHB index.As of writing the pair is losing 0.02% at 1.2466 facing the next support at 1.2436 (low Feb.10) followed by 1.2344 (low Feb.7) and finally 1.2250 (low Jan.19). On the other hand, a breakout of 1.2572 (high Feb.7) would open the door to 1.2680 (high Jan.26) and finally 1.2715 (high Feb.2).

USD/JPY: close above 114.23 to trigger additional gains Commerzbank

Karen Jones, technical analyst at Commerzbank, maintains a near-term positive bias for the USD/JPY major and see it rising immediately to 115.62 (Jan. 19 high) ahead of 16 month resistance line at 118.04. "USD/JPY last week recovered from circa the 38.2% retracement at 111.98 area and the 112.02 April high. The market has eroded the Imoku 2 resistance and will need to close above here (114.23) to trigger gains to the 115.62 19th January high. A close above here is needed to reintroduce scope to key short term resistance offered by the 16 month resistance line at 118.04."

USD/CAD retreats from 1.3100, Yellen, data eyed

The greenback is losing some upside momentum vs. its neighbour on Wednesday, motivating USD/CAD to return to sub-1.3100 levels ahead of key data in the US docket.Spot is trading with marginal losses today despite the persistent bid tone around the greenback following yesterday?s testimony by Chair Yellen and supportive Fedspeak.Market bets for a rate hike in March has gathered renewed traction after Chief Yellen added to the view of gradual and further rate hikes this year. In the same direction, Yellen noted it would be ?unwise? to wait too long to tighten further the monetary policy.Furthermore, Richmond Fed J.Lacker suggested the Fed may need to hike more than three times this year, advocating for a rate hike at the March meeting.Data wise today, the second testimony by Yellen before the House Financial Services Committee will be in centre stage, seconded by US inflation figures gauged by the CPI, Industrial Production, TIC Flows, the Empire State index, January?s Retail Sales, the NAHB index and the weekly report on crude oil inventories by the EIA.In Canada, Manufacturing Shipments are only due.As of writing the pair is losing 0.05% at 1.3068 facing the next support at 1.3046 (low Feb.13) seconded by 1.3016 (low Jan.17) and then 1.2967 (low Jan.31). On the other hand, a surpass of 1.3109 (high Feb.14) would aim for 1.3122 (20-day sma) and finally 1.3215 (high Feb.7).

AUD/USD losing upside momentum UOB

FX Strategists at UOB Group stay bullish on the Aussie Dollar, although the upside momentum could be running out of steam.?We turned bullish about 2 weeks ago when AUD broke above 0.7600. Since then AUD has been caught in a 0.7605/0.7696 range and has been unable to much headway despite overall bullish indications?.?While the price action appears to be forming a ?bullish flag?, the rapidly deteriorating upward momentum suggests that time is running out for AUD bulls?.?Unless there is a clear break above 0.7695/00 soon, the risk of short-term top would grow quickly but confirmation is only upon a break below the current stop-loss at 0.7615 (the overnight low of 0.7618 came very close to this level)?.?After the prolonged consolidation, a clear break above 0.7695/00 could unleash a rapid acceleration higher towards 0.7775/80 (high in November last year)?.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.