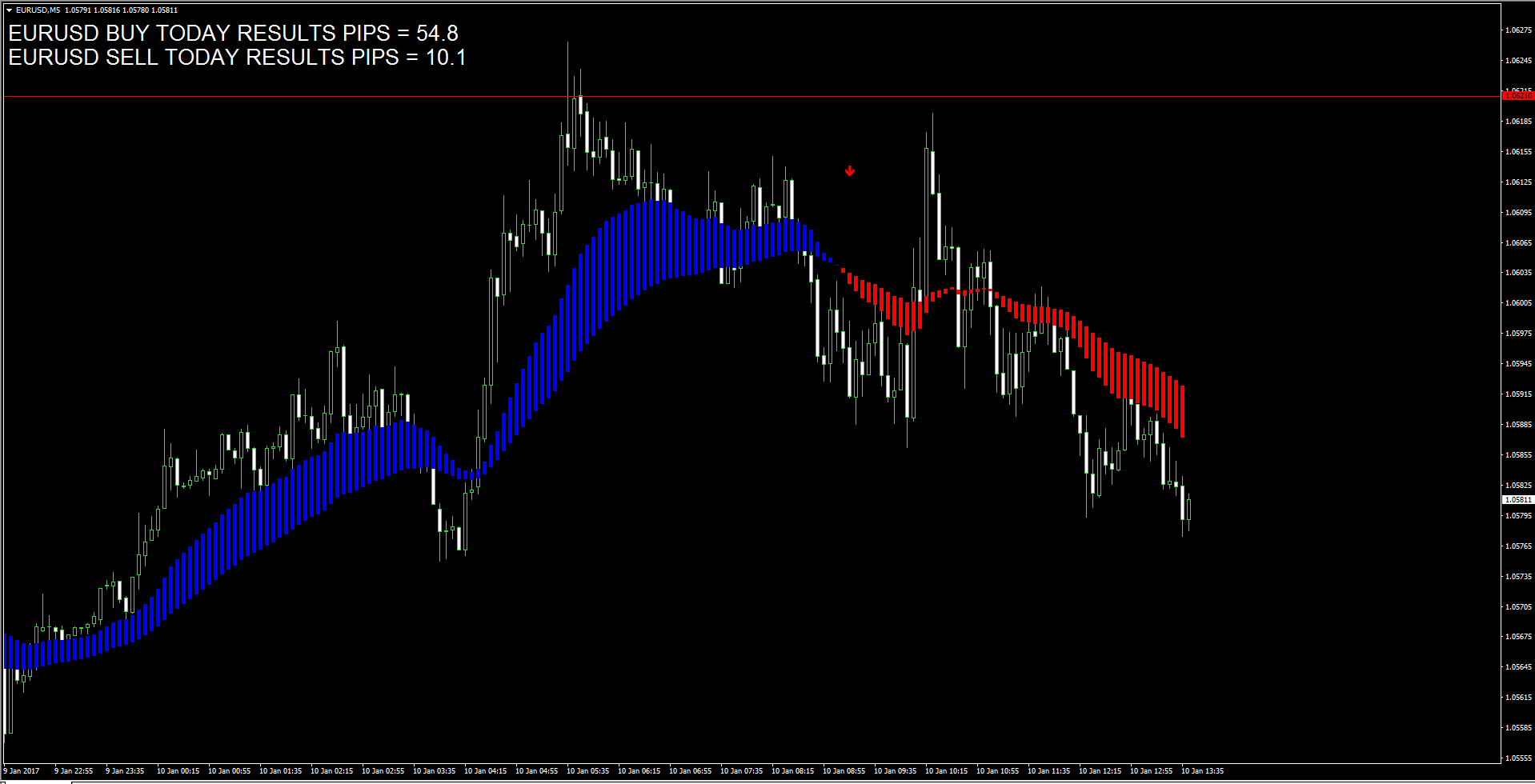

EUR/USD again rejected near 1.0620 region, surrenders daily gains

The EUR/USD pair once again faced rejection near 1.0620 strong horizontal resistance and is now headed toward the lower end of daily trading range.Currently trading around 1.05780 region, testing session low, the pair initially built on Monday's up-move and jumped to the highest level since mid-December. The up-move, however, turned out to be short-lived and the pair continued with its struggle to sustain strength above 1.0600 handle. Renewed greenback buying interest, with the key US Dollar Index reversing majority of its early losses, and attempting to regain traction, seems to be the key driver of the pair's retracement move from 4-week high level of 1.0627. With a relatively thin US economic docket, featuring the only release of JOLTS job openings, the pair's price action on Tuesday is pointing towards repositioning ahead of the President-elect Donald Trump's first news conference on Wednesday. Rejection from an important horizontal resistance, and a subsequent break below 1.0550 immediate support, would negate possibilities of any near-term recovery and drag the pair back towards 1.0500 psychological mark, en-route 1.0470-65 support area.On the flip side, momentum back above 1.0600 handle might continue to confront strong resistance near 1.0620 region. Hence, a convincing break through this strong resistance should now trigger a sharp short-covering rally and lift the pair beyond 50-day SMA immediate hurdle near 1.0650-55 region and 1.0700 handle, towards testing its next major hurdle near 1.0765-70 region.

GBP/USD bounces-off 1.2100 neighborhood

The GBP/USD pair has managed to defend 1.2100 handle and recovered around 40-pips from the vicinity of 1.2100 handle touched earlier. Currently trading around mid-1.2100s, the pair on Tuesday remained under selling pressure for the third consecutive session and tumbled to its lowest level since Oct. 25 in wake of fresh worries over a 'hard Brexit'. The selling pressure surrounding the British Pound, however, stalled amid some long-dollar unwinding as investors turned cautious ahead of the President-elect Donald Trump's first news conference on Wednesday.Meanwhile, expectations of steeper Fed rate-hike actions in 2017 continued to underpin demand for the greenback and might restrict any swift recovery for the major. Even from technical perspective, the pair has decisively broken below 1.2200 strong horizontal support and hence, a follow through selling pressure would turn it vulnerable to continue drifting lower in the near-term.Immediate support on the downside remains near 1.2100-1.2080 region, which if broken decisively would open room for a retest of early October flash crash swing lows support near 1.20 psychological mark. Meanwhile on the upside, any recovery attempt might now face immediate strong resistance near 1.2200 handle above which a fresh bout of short-covering has the potential to lift the pair towards 1.2280-85 resistance, en-route its next major hurdle near 1.2340-50 region.

USD/JPY clings to the sideline pattern UOB

FX Strategists at UOB Group have noted USD/JPY remains within a broader 115.50/118.60 range for the time being. ?USD edged above the 117.45/50 resistance indicated yesterday to hit a high of 117.52. The unexpected sharp and swift drop from the high is gaining momentum rapidly and the immediate bias is clearly tilted to the downside. That said, any weakness is unlikely to have enough momentum to move below last week?s low near 115.00/05 (minor support at 115.40)?.?USD touched a high of 117.52 yesterday but the up-move was short-lived. The rapid drop has shifted the short-term risk to the downside but at this stage, it is too early to expect a sustained down-move. That said, a move below last week?s 105.00/05 would not be surprising and such a development would indicate a deeper probe towards the major 114.00 support has started?.

NZD/USD neutral in a 0.6920/0.7055 UOB

The Kiwi Dollar is seen meandering between 0.6920/0.7055 vs. the greenback for the next weeks, according to FX Strategists at UOB Group.?The registered low of 0.6949 did not challenge the strong support indicated at 0.6925/30 yesterday. The subsequent rapid rise from the low appears to have scope to extend further but any up-move is expected to struggle near the major 0.7045/50 resistance?.?While upward momentum has improved, it is too early to expect a sustained up-move as 0.7055 is a very strong resistance and this level is unlikely to yield so easily. Overall, we prefer to hold a neutral stance for now even though the short-term bias is tilted to the upside (as long as 0.6950 is intact)?.

Gold close to session highs near $1,190

The softer tone in the greenback is promoting the ounce troy of the precious metal to advance to the area of $1,185/90, daily tops.The demand for the yellow metal remains quite firm for the second session in a row on Tuesday, bolstered by the selling mood around the US dollar as jitters regarding tomorrow?s press conference by president-elect Donald Trump keeps undermining the sentiment.Bullion has been gathering fresh traction since the release of the FOMC minutes, where the Committee noted the considerably uncertainty that surrounds the potential policies under Trump?s presidency.In addition, traders? attention re-focused on the yellow metal as scepticism over the projected 3 rate hikes by the Federal Reserve during the current year remains on the rise.As of writing Gold is gaining 0.01% at $1,185.90 and a breakout of $1,191.48 (55-day sma) would open the door to $1,219.05 (50% Fibo of the 2016 up move) and then $1,239.61 (100-day sma). On the other hand, the next support is located at $1,171.50 (low Jan.5) ahead of 1,146.50 (low Jan.3) and finally $1,126.50 (low Dec.20).

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.