EUR/USD turns negative near 1.0450, ignores upbeat Ifo

The retreat from daily tops in the EUR/USD pair gains traction in the mid-European session, knocking-off the major in the red zone below the mid-point of 1.04 handle.Currently, EUR/USD inches -0.07% lower to hover near fresh daily lows of 1.0441, with the bears now eyeing a test of 1.4000 levels. A solid broad recovery staged by the US dollar prompts a fresh sell-off in the EUR/USD pair from around 1.0465 region, seen following the release of upbeat German Ifo surveys.Hence, its shows that the major continue to remain at the mercy of USD dynamics, having ignored a solid rebound in the German business sentiment and upbeat Eurozone construction output and labor costs data.Moreover, negative performance on the European equities also failed to lift the sentiment around the funding currency euro, as focus now shifts towards the second-tier data.

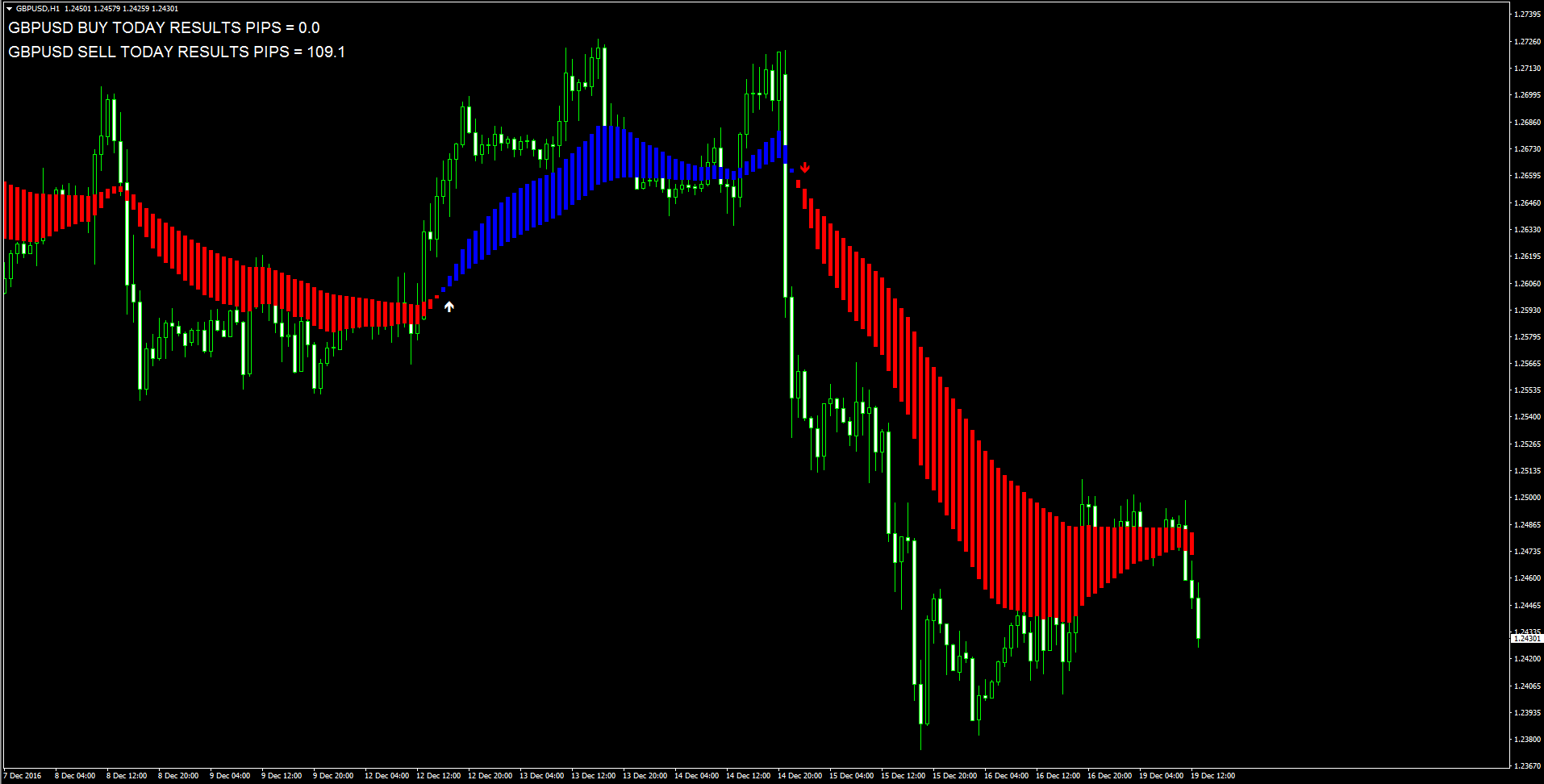

GBP/USD rejected at 1.2500, comes down to test 50-DMA

The GBP/USD pair managed to reached 1.25 handle, however, quickly ran through fresh sellers at the last, now extending the retreat to hit fresh daily lows near 1.2460.The cable came under fresh selling pressure amid resurgent demand for the US dollars versus its main competitors, as risk-off moods appear to have eased amid a recovery in the European equities and US treasury yields.While fresh selling in the GBP/JPY cross also adds to the renewed downside in the GBP/USD pair, after the bulls failed once again to take the rate above 1.25 handle.A dry-economic calendar and thin markets also keep the sentiment around the major largely subdued.In terms of technical levels, upside barriers are lined up at 1.2500 (zero figure/ daily high), 1.2555 (10-DMA) and 1.2573 (20-DMA). While supports are seen at 1.2458/57 (daily low/ 50-DMA) and 1.2400 (round figure) and below that at 1.2357 (Nov 23 low).

USD/JPY volatility expensive compared to Nikkei volatility - SocGen

Research Team at Societe Generale suggests that one of their key market themes was that the BoJ?s peg of long-term yields will transfer the suppressed rate volatility to the currency and equities and the USD/JPY volatility already benefited from the volatility boost while Nikkei volatility remains on its lows:?USD/JPY volatility already has benefited from an impressive topside acceleration. But the yen depreciation should be more gradual as BoJ won?t act while US rates have picked up post the US election and following the Fed?s adjustment higher of the dot plot. The market is due to take a breather which will dampen USD/JPY realised volatility.? ?In contrast, Nikkei volatility remains on its lows a positive directional bias on Nikkei is expected to be accompanied by higher volatility.??Statistical analysis suggests that the FX/Equity volatility spread is likely to mean-revert very soon.?

USD/CAD attempting a fresh move towards 1.3400 handle

The USD/CAD pair gained further traction during European trading session and has now jumped to a fresh session peak, albeit remained below last week's 10-day high level beyond 1.3400 mark. Currently trading around 1.3365-70 region, the pair was seen building on to hawkish Fed statement-led sharp recovery move from the vicinity of the very important 200-day SMA. The pair, however, has repeated failed (in past two trading sessions) to sustain its move above 50-day SMA as rising crude oil prices, which tends to benefit the commodity-linked currency - Loonie, has been the key factor restricting the pair's up-move. The pair is now making yet another attempt to build on to its momentum above the said moving average, despite of buoyant sentiment surrounding oil prices. Hence, a follow through buying interest above 1.3400 handle would confirm a bullish break-out and open room for continuation of the pair's near-term upward trajectory.In absence of any major market moving economic releases, the pair would continue to be driven by oil market price dynamics and the broader sentiment surrounding the greenback as markets digest last week's hawkish FOMC statement.From current levels, 1.3400 handle remains immediate strong hurdle, which if conquered is likely to boost the pair beyond 1.3417 (Dec. 15 high) towards 1.3440 resistance (Dec. 1 high). On the downside, sustained weakness below 1.3345-40 region (50-day SMA), leading to a break below 1.3315-10 horizontal support, is likely to accelerate the slide towards 1.3280-75 horizontal resistance, en-route 1.3235 support area.

AUD/USD dumped on DXY recovery & copper sell-off

The offered tone behind the US dollar weakens in mid-Europe, fuelling a fresh selling spiral in the AUD/USD pair towards daily troughs.Currently, the AUD/USD pair drops -0.41% to fresh session lows of 0.7377, having faced heavy supply at 0.73 handle. The Aussie is the weakest amongst the commodities-currencies, having faced double whammy from renewed strength in the US dollar and heavy losses seen in copper prices.Moreover, a retreat in oil prices coupled with softer European equities; also collaborate to a fresh selling-wave seen around the higher-yielding AUD. Meanwhile, the USD index recovers almost entire losses to now trade around 102.85 levels, up from 102.50 lows, while Comex copper futures slump -1.30% to $ 2.53/ pound.Markets also looked past the optimism triggered by upbeat Australian Government's Mid-year Economic and Fiscal Outlook (MYEFO) and narrowing budget deficits, as AUD/USD price action is centered on the USD moves and RO-RO trends amid a data-light trading session today.The pair finds the immediate resistance at 0.7301 (daily tops) above which gains could be extended to the next hurdle located 0.7328 (5-DMA) and 0.7400 (10-DMA). On the flip side, the immediate support located 0.7263 (daily S2). Selling pressure is likely to intensify below the last, dragging the Aussie to 0.7250 (psychological levels) and below that at 0.7200 (zero figure).

WTI firmer above $ 53 amid weaker DXY & upbeat outlook

Oil futures on NYMEX moved off highs, although clings to gains above $ 53 mark, as investors ?sentiment remains favorable amid hopes of tighter markets in 2017 and a negative US dollar across the board.Currently WTI advances +0.60% to $ 53.27, having found fresh demand just ahead of 53 handle. Oil prices are seen consolidating in positive territory, with the bulls finding impetus from expectations of tighter oil markets next year.While broad based profit-taking slide seen in the US dollar, after last week?s hawkish Fed-led rally, also keeps the sentiment buoyed around the USD-sensitive oil. A weaker dollar makes the USD-denominated commodity cheaper for foreign buyers.Moreover, upgrade revisions to the Oil price forecasts for 2017 by Goldman Sachs and JP Morgan, further adds to the bullish tone behind oil prices.Markets now look forward to the weekly crude stockpiles report from the US due later this week for further insights on the supply-side scenario.A breach of support at $53 (zero figure) would expose the 10-DMA support of $52.22. While a break above $53.59 (daily top) could yield a test of Dec 12 high at 54.51.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.