EUR/USD slips back to 1.0620, session lows

The better tone in the greenback is now prompting EUR/USD to intensify the downside to the area of daily lows in the 1.0625/20 band.The pair has quickly faded yesterday?s spike to the 1.0660 region, sparking the current leg lower following a rebound in the demand for the buck.In the meantime, EUR/USD is retreating for the first time after four consecutive advances so far today, bouncing off last week?s fresh 2016 lows near 1.0510 although finding quite tough resistance in the mid-1.0600s for the time being.Spot is poised to remain under pressure in light of the critical OPEC meeting due later today as well as the release of advanced CPI figures in the euro area for the current month.Additionally, and on the USD-side, the ADP report is expected to show that the US private sector has added 160K jobs in November, up from October?s 147K. Further publications in the US docket comprise Personal Income/Spending, inflation figures tracked by the PCE, the Chicago Fed PMI and Pending Home Sales, all preceding the Fed?s Beige Book. In addition, FOMC?s J.Powell (permanent voter, neutral) and Cleveland Fed L.Mester (voter, hawkish) are due to speak. The pair is now down 0.25% at 1.0623 facing the initial support at 1.0515 (2016 low Nov.24) followed by 1.0457 (2015 low Mar.16) and then 1.0332 (monthly low January 2003). On the other hand, a break above 1.0685 (high Nov.28) would target 1.0700 (23.6% of the November drop) en route to 1.0820 (low Mar.10).

GBP/USD rebounds to test 1.2500 on BOE?s Carney, Oil

After a brief stint to the downside, the GBP/USD pair staged a solid comeback post-European open, now testing highs near 1.25 handle.The cable found fresh bids once again near 1.2470 region, fuelling another run to reclaim 1.25 handle, but in vain, as bears continue to guard the last, despite subdued trading activity seen behind the US dollar versus its main peers.The rebound in the GBP/USD pair can be partly attributed to optimistic remarks delivered by the BOE Governor Carney on the UK?s financial system, during his press conference today following the BOE?s Financial Stability Report (FSR) release.While sharp recovery in oil prices lifted the sentiment around the commodity-heavy FTSE 100 index, eventually boosting the risk-on flows in the GBP. Both crude benchmarks are up almost 4%.Next of note for the major remains the US economic releases, while the OPEC-related news flows will also have some bearing on the risk currency. In terms of technical levels, upside barriers are lined up at 1.2500/02 (round number/ daily high), 1.2533 (Nov 28 high) and 1.2550 (daily R1). While supports are seen at 1.2447 (10-DMA) and 1.2375 (50-DMA) and below that at 1.2357 (Nov 23 low).

USD/JPY could revisit 111.45 and 110.27 Commerzbank

In view of Karen Jones, Head of FICC Technical Analysis at Commerzbank, the pair could attempt another test of 111.45 and 110.27. ?USD/JPY reached the 113.80/114.87 resistance area which consists of the mid-February-to-March highs. It capped as expected, we note the 13 count on the 240 minute chart and TD resistance at 113.90. The late May 111.45 high and also at the 110.27 November 22 low are still expected to be revisited. Note the Elliott wave count is suggesting a retracement into the 110.90/109.05 band. This is the 23.6% and 38.2% retracement of the last leg up. We are looking for a shallow correction only?.

USD/CHF stuck in a trading range above 1.0100 handl

The USD/CHF pair extended its near-term consolidation phase within 100-pips broader trading band and is heading back towards the top end of the range. Currently trading around 1.0150 region, the pair caught fresh bids near 1.0100 handle and regained traction on Wednesday after failing to build on upbeat US economic data-led strong move in the previous session. Tuesday's economic data reconfirmed that the Fed would certainly raise interest-rates on December 14. However, market participants now look for clarity over the Fed's monetary policy outlook beyond December meeting, leading to an indecisive price-action around the major.Looking at the broader picture, the current phase of range-bounce movement could be categorized as a near-term consolidation phase following the pair's post-US election sharp up-surge of around 650-pips to the highest level since Feb. Hence, the incoming US macro data, including Friday's key NFP data, might now provide fresh impetus for the pair's next leg of directional move.In the meantime, today's US economic calendar featuring - ADP report, Core PCE Price Index, Chicago PMI and pending home sales data, might help traders to grab short-term momentum play.On the upside, 1.0170 area seems to act as immediate resistance above which the pair is likely to aim towards reclaiming 1.0200 handle and head towards testing yearly highs resistance near 1.0250-55 region. On the downside, 1.0100 handle now becomes immediate support, which if broken, leading to a weakness below 1.0075 weekly lows support, could accelerate the slide towards 1.0015-10 strong support.

USD/CAD cautious near 1.3430, OPEC eyed

The Canadian dollar is trading almost unchanged vs. its American neighbour on Wednesday, with USD/CAD navigating a tight range around 1.3430.The pair is looking to extend yesterday?s bullish attempt, recovering some extra ground after hitting lows in the sub-1.3400 area at the beginning of the week, all amidst an increasing cautious tone on the outcome of today?s OPEC meeting.CAD will remain specially vigilant on the performance of crude oil prices today in light of the upcoming OPEC gathering, with the barrel of West Texas Intermediate trading in a more volatile fashion in recent sessions, managing to advance more than 1% to the boundaries of the $46.00 mark at the time of reading.Following the latest CFTC report, CAD speculative net shorts have decreased to 3-week lows during the week ended on November 22.Apart from the OPEC event, Statistics Canada will publish the GDP figures for the month of September, while today?s releases in the US docket include the ADP report, followed by Personal Income/Spending, inflation figures tracked by the PCE, the Chicago Fed PMI and Pending Home Sales, all preceding the Fed?s Beige Book. In addition, FOMC?s J.Powell (permanent voter, neutral) and Cleveland Fed L.Mester (voter, hawkish) are due to speak.As of writing the pair is gaining 0.04% at 1.3437 and a break above 1.3566 (high Nov.18) would aim for 1.3575 (50% Fibo of the 2016 drop) and finally 1.3590 (high Nov.14). On the flip side, the immediate support aligns at 1.3374 (low Nov.22) ahead of 1.3311 (38.2% Fibo of the 2016 drop) and finally 1.3260 (low Nov.9).

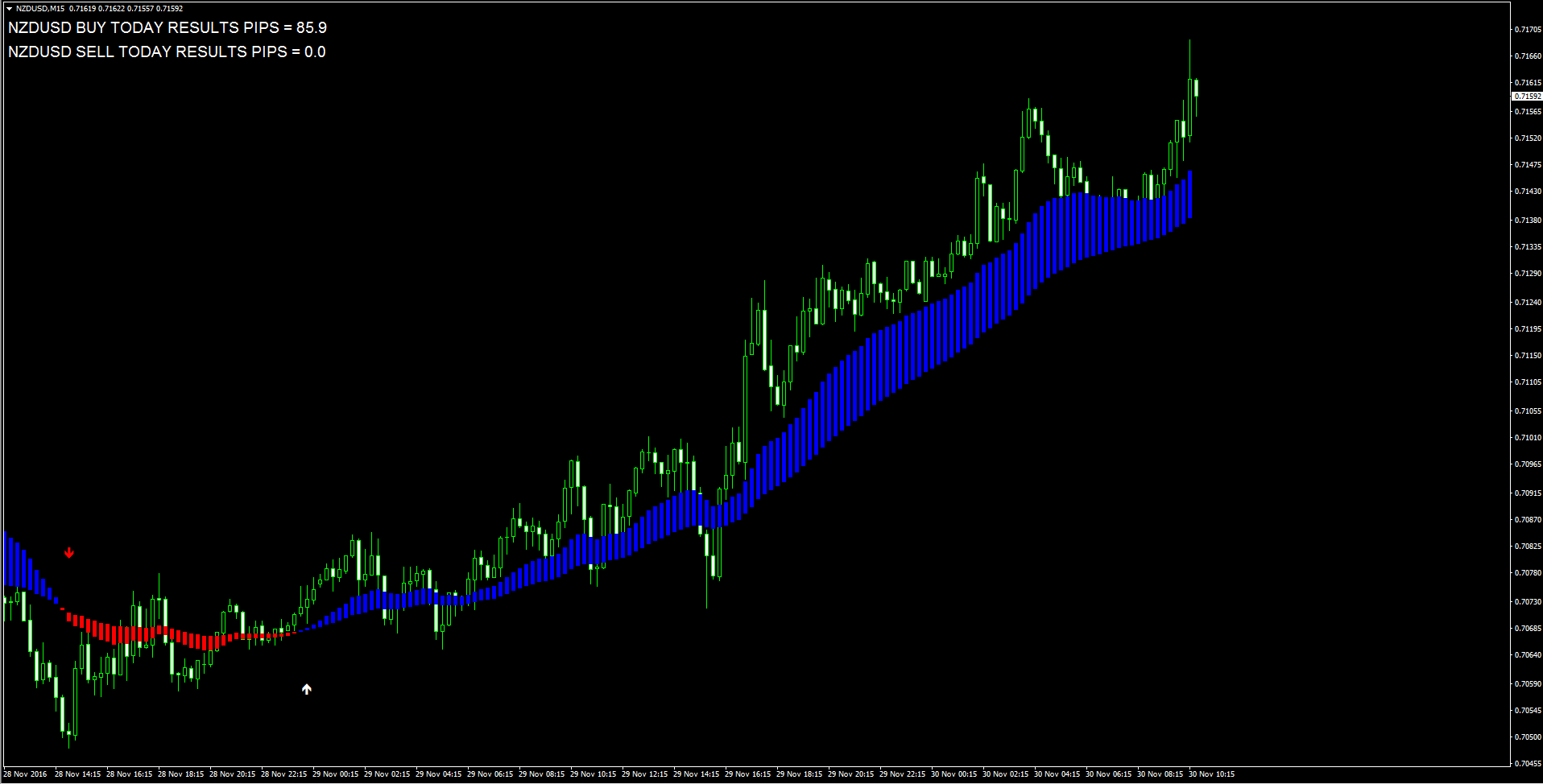

NZD/USD well-bid for fourth straight session

The NZD/USD pair extended its near-term upward trajectory for the fourth consecutive session and is now building on to momentum back above 0.7100 handle.Currently trading around mid-0.7100s, the pair maintained its strong bid tone after RBNZ Governor Graeme Wheeler said that he expected the December CPI to move back to the central bank's target band. Wheeler's comments added on to the upbeat sentiment surrounding the New-Zealand dollar led by receding possibilities of further interest rate cuts in the foreseeable future after RBNZ's highlighted housing market risks in its latest financial stability report. Investors on Wednesday will remain focused on the final outcome from OPEC meeting, which might influence investors' risk-appetite and eventually provide impetus for riskier / higher-yielding currencies - like the Kiwi. Meanwhile, today's US economic calendar featuring the releases of ADP report on private sector employment, Fed's preferred inflation gauge - Core PCE Price Index, Chicago PMI and pending home sales would grab attention during NA trading session and would be looked upon for short-term trading opportunities. A follow through buying interest above session peak resistance near 0.7160 seems to boost the pair immediately towards 100-day SMA resistance near 0.7195 region ahead of resistance near 0.7228 level (Nov. 11 high). On the downside, 0.7125 level (session low) is likely to drag the pair below 0.7100 handle towards previous resistance, now turned support, near 0.7085 region.

Gold erases tepid recovery gains, Fed rate-hike expectations continue to weigh

Gold reversed early attempted tepid recovery gains to session peak level near $1195 region and has now turned absolutely flat for the day. Currently trading around $1188 region, nearly unchanged from yesterday's closing level, the precious metal extended its near-term consolidation phase closer to multi-month lows touched last week. Even the prevalent uncertainty around OPEC-deal has failed to boost the metal's safe-haven appeal. Growing expectations of higher interest-rates in the US, even beyond December meeting, has been the key factor weighing on the non-yielding metal and restricting any swift near-term recovery. Today's US economic docket that includes - ADP report on private sector employment, Fed's preferred inflation gauge - Core PCE Price Index, Chicago PMI and pending home sales data, might provide some impetus for short-term traders. However, Friday's NFP data would be a key determinant for the US Dollar's near-term trajectory and would eventually drive dollar-denominated commodities - like gold. Immediate downside support is pegged near $1181-80 region below which the commodity could head back towards retesting multi-month lows support near $1171 region. A convincing break below $1171-70 support now seems to open room further near-term downslide towards $1152-50 support area.On the upside, $1195 region now seems to have emerged as immediate strong hurdle, which if cleared should trigger a short-covering bounce beyond $1200 handle towards its next major resistance near $$1207-08 region.

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.