EUR/USD stuck in tight range above 5-DMA

The bulls are seen guarding the 1.1000 barrier, with the EUR/USD pair bouncing-off the last on every attempt to the downside.Currently, EUR/USD rises +0.18% to 1.1018, finding good support at 5-DMA. The main currency pair regains poise and tries another attempt to extend above 1.1130 barrier, as the US dollar selling continues on the back of profit-taking, after last week?s extensive rally, heading into the US CPI report due later in the NA session.However, further upside lacks momentum as steep losses in the EUR/GBP cross keeps a check on EUR. Next of note for the major remains US CPI figures due later on the day and Thursday?s ECB policy decision for fresh impetus on the spot.In terms of technicals, the pair finds the immediate resistance 1.1027 (daily high). A break beyond the last, doors will open for a test of 1.1050 (psychological levels) and from there to 1.1072 (Oct 12 high). On the flip side, the immediate support is placed at 1.1000 (5-DMA) below which 1.0982 (Oct 13 low) and 1.0954 (3-month low) could be tested.

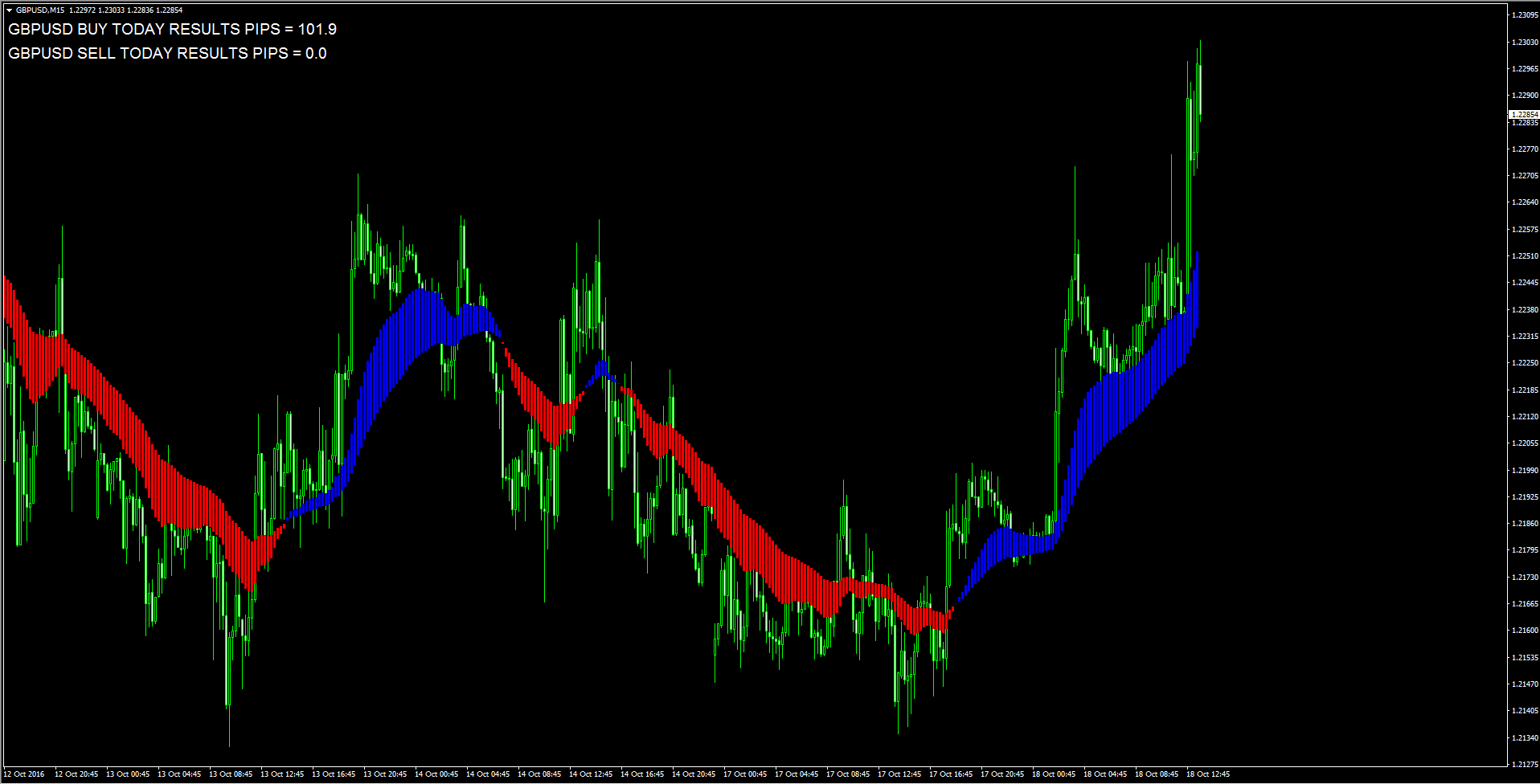

GBP/USD advanced to 1.2280 post-CPI

The Sterling met extra buying interest following the release of UK?s CPI figures, sending GBP/USD to fresh peaks in the 1.2280 area.The pair clinched fresh daily highs after consumer prices in the UK economy have surprised to the upside during September. In fact, headline CPI rose at an annualized 1.0%, while Core CPI gained 1.5% over the last twelve months vs. initial estimates at 0.8% and 1.4%, respectively.Spot is thus extending its weekly upside to the upper 1.2200s for the time being, although it keeps the trade within the recent range amidst a broad-based selling bias around the greenback.In that regard, today?s price action will be put to the test later in the NA session in light of the publication of US inflation figures measured by the CPI, seconded by the NAHB index and TIC Flows.Market expectations of a Fed?s move by year end remains the exclusive driver behind USD-rally, although its upside momentum seems to have ebbed somewhat at the beginning of the week, allowing the ongoing rebound in the risk-associated universe.As of writing the pair is gaining 0.44% at 1.2238 and a break above 1.2377 (high Oct.11) would open the door to 1.2644 (20-day sma) and finally 1.2761 (high pre-?flash crash? Oct.7).

EUR/GBP extends UK CPI-led slide, hits 7-day low

The EUR/GBP cross ran through fresh offers following upbeat UK CPI print and extended its slide further below 0.9000 handle to 7-day low.Currently trading around 0.8960 region, the cross came under selling pressure and accelerated the downslide after UK consumer prices, as measured by CPI, printed the highest level since Nov. 2014 and came-in at 1.0% y-o-y as compared to previous month's 0.6% and 0.8% expected. Further downslide, however, seemed limited amid ongoing recovery in the EUR/USD major led by a broad based US Dollar weakness following Monday's dismal US manufacturing data, which dimmed prospects of an eventual Fed rate-hike move. Traders now look forward to this week's other key UK macro releases, including employment report and monthly retail sales data, and ECB monetary policy decision, which would help determine the next leg of directional move for the cross.A follow through selling pressure is likely to drag the cross immediately towards 0.8935 before the downward trajectory gets extended towards 0.8900 handle. On the upside, any recovery attempt might now confront resistance at 0.9000 psychological mark above which the momentum seems to lift the cross towards 0.9040-45 resistance area.

NZD/USD inter-market

The Kiwi is the top performer in today?s trading session so far, accelerating northwards to clinch 0.72 handle. The New Zealand dollar extends its bullish streak into a second day this Tuesday, amid a generalized selling seen in the greenback after yesterday?s dismal economic performance from the US economy.A poor streak of US economic data poured cold water over Fed?s rate hike prospects this year and hence steepened the treasury yields curve, as the 2-year treasury yields, which reflect short-term interest rates expectations, drop sharply. This widened the NZ-US 2-yr yield spread in favor of a stronger NZD, which is seen as one of the main reason behind the ongoing rally in the major.Besides, higher oil and metal?s prices combined with falling VIX futures (fear gauge), also add to the upbeat tone behind NZD/USD. While the bulls continue to cheer stronger-than expected NZ CPI data released earlier on the day. NZ CPI unexpectedly rose in Q3 versus no growth expected during the same period. More so, a latest RBNZ report showed that 3Q sectoral factor model inflation index rose 1.5% y/y,All eyes now remain on the US CPI report and New Zealand Fonterra?s fortnightly dairy auction results due later in the NA session. While the main risk event for this week remains the Chinese GDP figures due on the cards tomorrow, along with industrial production and retail sales data.

GBP/JPY clings to gains above 127.00 handle after UK CPI

The GBP/JPY cross held on to its strength above 127.00 handle and is currently trading close to session high near 127.40 following upbeat UK CPI print.According to Tuesday's data, released by the Office for National Statistics, UK CPI rose to 1.0% y-o-y in September, marking the highest level since November 2014 and surpassed consensus estimates of 0.8% and previous month's 0.6%. Meanwhile, the core inflation also edged higher to 1.5% in September as compared to 1.4% expected. Moreover, upbeat sentiment around European equity markets is denting the Japanese Yen's safe-haven appeal and extending further support to the bid tone surrounding the GBP/JPY cross.Focus now shifts to this week's other important macro releases from UK, including employment report and monthly retail sales, while broader sentiment would continue be driven by any fresh news / developments related to Brexit.Immediate upside resistance is pegged at 127.93 (Oct. 14 high) above which the pair seems all set to aim towards 20-day SMA resistance near 129.45 region with 128.55 and 129.00 round figure mark acting as intermediate resistance levels. On the downside, sustained weakness back below 127.00 handle, leading to a subsequent drop below 126.85 horizontal support, is likely to get extended towards session low support near 126.25-20 region, which if broken might turn the cross vulnerable to head back towards 125.00 psychological mark support.

Gold finds support below $1,260 ahead of US data

The ounce troy of the precious metal keeps the weekly upside well and sound so far today, currently testing the $1,260/65 band ahead of US CPI figures.The yellow metal is extending its rebound from the $1,250 area, briefly testing highs around $1,270 although easing some ground soon afterwards. Anyway, Bullion remains underpinned by the (temporary?) offered bias around the greenback as market participants continue to cash up recent strong gains following lacklustre results from the US docket.Additionally, expectations of a Fed?s rate hike by year-end continue to lend support to the broader view of a stronger dollar in the next periods, capping occasional bullish attempts in the metal.Later in the NA session, US inflation figures measured by the CPI are due seconded by the NAHB index and TIC Flows.As of writing Gold is gaining 0.60% at $1,264.15 and a breakout of at $1,271.07 (200-day sma) would expose $1,312.86 (55-day sma) and then $1,344.45 (high Sep.23). On the other hand, the immediate support lines up at $1,249.50 (low Oct.5) followed by $1,219.05 (50% Fibo retracement of the 2016 up move) and finally $1,199.00 (low May.31).

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.