EUR/USD muted on EMU?s CPI, around 1.1180

The shared currency remained apathetic after the release of EMU?s CPI figures for the current month, with EUR/USD staying around the 1.1180/70 band.The pair kept the bearish undertone intact after advanced inflation figures in the region showed consumer prices are expected to rise at an annualized 0.4% during the current month, matching initial forecasts.Further data saw Core prices expected to rise 0.8% over the last twelve months, missing expectations for a 0.9% gain. Unemployment in the euro region stayed unchanged at 10.1% in August, coming in short of expectations for a drop to 10.0%.Spot remains entrenched in the negative territory as developments around the Deutsche Bank continue to weigh on investors? sentiment. Shares of the German lender continue to recover from the early drop to record lows around 9.90, currently hovering over 10.40, down more than 4%.On the US data space, Personal Income/Spending, PCE figures, the Chicago Fed PMI and the final print of the Reuters/Michigan index will take centre stage ahead of the speech by Dallas Fed R.Kaplan (2017 voter, neutral).The pair is now losing 0.34% at 1.1181 facing the immediate support at 1.1161 (200-day sma) followed by 1.1127 (2014-2016 support line) and then 1.1043 (low Aug.5). On the flip side, a break above 1.1271 (resistance line off 2016 high) would target 1.1279 (high Sep.26) en route to 1.1329 (high Sep.8).

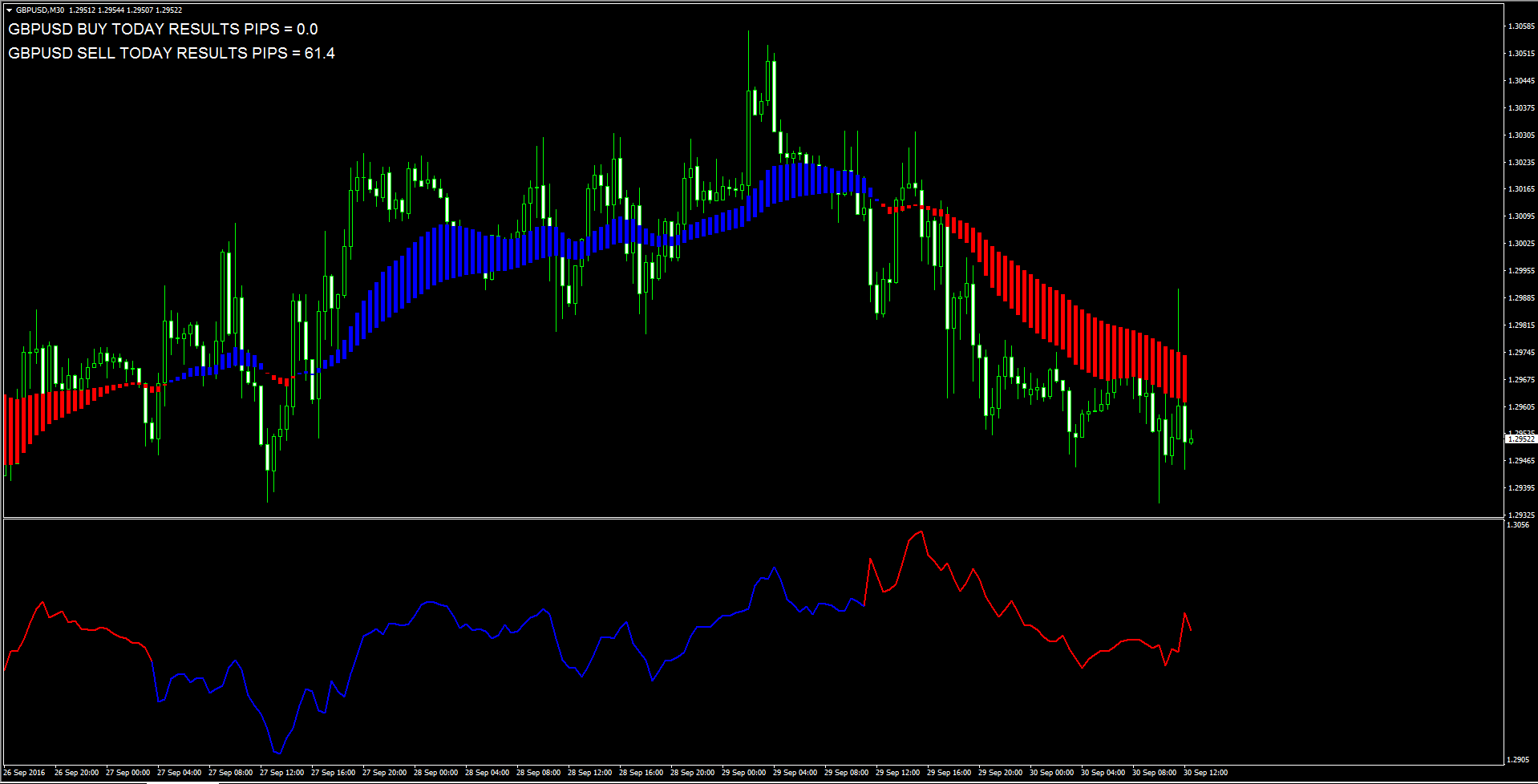

GBP/USD remains offered below 1.3027 - Commerzbank

In view of Karen Jones, Head of FICC Technical Analysis at Commerzbank, Cable remains directly offered while below 1.3027.?GBP/USD is seeing a tiny bounce from the base of a symmetrical triangle at 1.2927. We have a near term resistance line at 1.3047 (nearby high is 1.3119) and will consider that the market remains directly offered below here?.?A close below 1.2927, will trigger losses to the 1.2797/50 July low and the long term Fibonacci support. A close below here will be regarded as very negative and target circa 1.22 (this is the approximate measurement down from the symmetrical triangle pattern?)?.?We view the September high at 1.3443 as an interim high. Only if it and the late June high at 1.3534 were to be overcome would we neutralize our medium term negative outlook?.

US Dollar off highs, back near 95.60 ahead of US data

The greenback, tracked by the US Dollar Index, has quickly climbed to session highs above 95.70 although it has returned to the 95.60 area afterwards.The index met a bout of buying interest after shares of the German Deutsche Bank took a serious hit earlier in the European morning, at some point shedding around 9% to record lows near 9.90 although recovering a tad soon afterwards.In the meantime, USD manages well to keep the trade in the upper end of the range near session tops ahead of key US releases due later: inflation figures measured by the PCE, Personal Income/Spending, Chicago PMI and the final print of Consumer Sentiment gauged by the Reuters/Michigan index.In addition, Dallas Fed R.Kaplan (2017 voter, neutral) is due to speak later in the NA session, adding to the weekly slew of Fed speakers following the FOMC meeting last week. It is worth noting that KC Fed E.George has reiterated yesterday that it is time for the Federal Reserve to hike rates.The index is gaining 0.17% at 95.69 and a break above 95.97 (200-day sma) would aim for 96.31 (spike post-BoJ Sep.21) and finally for 96.50 (high Aug.5). On the flip side, the immediate support lines up at 94.92 (support line off 2016 low) ahead of 94.44 (low Sep.8) and finally 94.05 (low Aug.18).

Deutsche Bank worries weighing on European equity markets

Deutsche Bank worries continued weighing on European markets, with most major indices witnessing a steep fall during early trade on Friday. A sharp slide in the shares of Deutsche Bank AG triggered losses across the financial sector as markets reacted to the reports suggesting that some of the biggest clients, which included several big hedge funds, have been pulling funds out of Deutsche Bank.The stock, however, has recovered from lows, bringing some stability in the broader indices. At the time of writing German DAX was off session low but remained in negative territory with a cut of around 1.5% while the broader, Stoxx Europe 600 index was down over 1.0%.Carol Harmer, Founder at charmertradingacademy.com, notes, "A break below here will send another bearish signal to the market and we would then be looking at the 10160 initially, with greater potential to try for the 10070....Now we know this was excellent resistance in the way up...likewise it will act as good support on the way down...Now if you want confirmation of a break lower you can wait util we have broken small trendline support at 10200....."

Gold jumps to $1327 as risk-aversion grips global markets

With risk aversion taking front seat during early European trading session, Gold has managed to attract some safe-haven flows and is now building on to Thursday's recovery momentum.Currently trading around $1326-27 area, the precious metal has nearly erased all of its losses recorded in the previous two trading session. The metal on Thursday touched a 6-day low level of $1316 immediately after the second quarter US GDP was revised higher to show an annualized economic growth of 1.4% before staging a turnaround amid sharp slide in US equity markets, led by worries over Deutsche Bank's performance, which boosted demand for traditional safe-haven assets. On Friday, Deutsche Bank uncertainty continues to weigh on investors sentiment and is further boosting the investment appeal of the precious metal. Moreover, renewed weakness in crude oil price is clearly suggesting that the markets have digested global optimism led by late Wednesday's new over production curbs by major oil producers. Focus now shifts to a slew of US economic releases, which include - the Fed's preferred inflation measure, Core PCE Price Index, Personal Income & Spending data, Chicago PMI and Revised UoM Consumer Sentiment, and might provide some impetus for short-term traders. On a sustained move above $1327, the metal seems to aim back towards testing 50-day SMA resistance near $1332 region above which a fresh bout of short-covering could lift it back towards $1337-38 strong horizontal resistance.Meanwhile on the downside, $1320 now becomes immediate support, which if broken would negate any near-term bullish bias and drag the commodity below weekly low support ear $1316 level, towards testing its next major support near $1310 area, also coinciding with 100-day SMA.

NZ building consents: Positive, amidst volatility - ANZ

Phil Borkin, Senior Economist at ANZ, suggests that while NZ?s dwelling consent issuance fell again in August, ANZ still view this as a positive outcome.?With issuance to date only retracing around half of June?s surge, a clear positive trend (across most of the country) remains. And while we are mindful of capacity pressures (and also an altered funding backdrop for developers), it is a positive trend that we believe has further to run yet. Low interest rates, house price gains, net migration, a clear push from policy makers, solid business confidence and infrastructure demands should ensure the construction sector continues to be a key contributor to overall GDP growth for a while yet.The number of dwelling consents dipped 1.0% in August (which is the second consecutive fall). However, the level of issuance is still well above where it was over the first half of the year. After rising 20% m/m in June, issuance has only retraced about half of that fall over the subsequent two months. In three month annualised terms, total issuance is running at close to 33K - the strongest since mid-2004.In terms of the composition, issuance for ?houses? rose 4.4% m/m, while multi-dwelling consents (which is far more volatile) fell 12% m/m.The trend for new dwellings in Auckland is increasing following a recent tailing off. On a trend basis, issuance is rising particularly strongly in Wellington and the South Island (ex-Canterbury).The value of non-residential consents is also trending higher. While down from the results in June and July, non-residential consents were still valued at over $500m in August, with Statistics NZ indicating the underlying trend is running at a 1.3% m/m pace.We are mindful that capacity constraints and associated cost increases will limit the sector?s ability to grow strongly from here. That said, we do note that one proxy of cost inflation from today?s data (the value of consents per square metre) has been a little more contained recently. In August it was up just 5.6% on year ago (3-month average), which is down from its recent high.?

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. We assume no liability for any loss arising from any investment made based on the information provided in this communication.