EUR/USD inter-markets

EUR/USD has gained over a cent since weekly lows in the 1.1120 area seen on Wednesday, not only retaking the 1.1200 handle but also advancing to multi-day peaks near 1.1250.USD-dynamics, especially following yesterday?s FOMC meeting, has been behind the up move in the pair, although the downside in the greenback appears shallow a priori. In fact, yields in the US money markets are supportive of the buck today and at the same time widening the differential spread vs. their German peers. In the same line, despite Fed Fund futures prices have retreated from recent tops, the Committee has yesterday pointed to a rate hike by year-end, with the probability of higher rates climbing to nearly 52%, according to CME Group?s FedWatch tool. Still on the USD-side, the US Dollar Index (DXY) remains well underpinned by the support line off YTD low seen on May 3, today around 94.80, as proved by several test during august and September.

On the opposite side and favouring the ongoing risk-on sentiment, volatility tracked by VIX remains on its way down from last week?s tops near 19% to levels around 13.30%. Regarding FX, and considering a continuation of the current upside in EUR/USD, the initial hurdle emerges at the 1.1260/80 band, home of the 23.6% Fibo retracement of the June-August up move and the resistance line off 2016 peak. If cleared, recent tops above the 1.1300 handle are next ahead of August?s top near 1.1370. On the other hand, there is quite a strong support in the 1.1160/50 region, where sit the 55-/200-day sma, and the 2014-2016 support line.

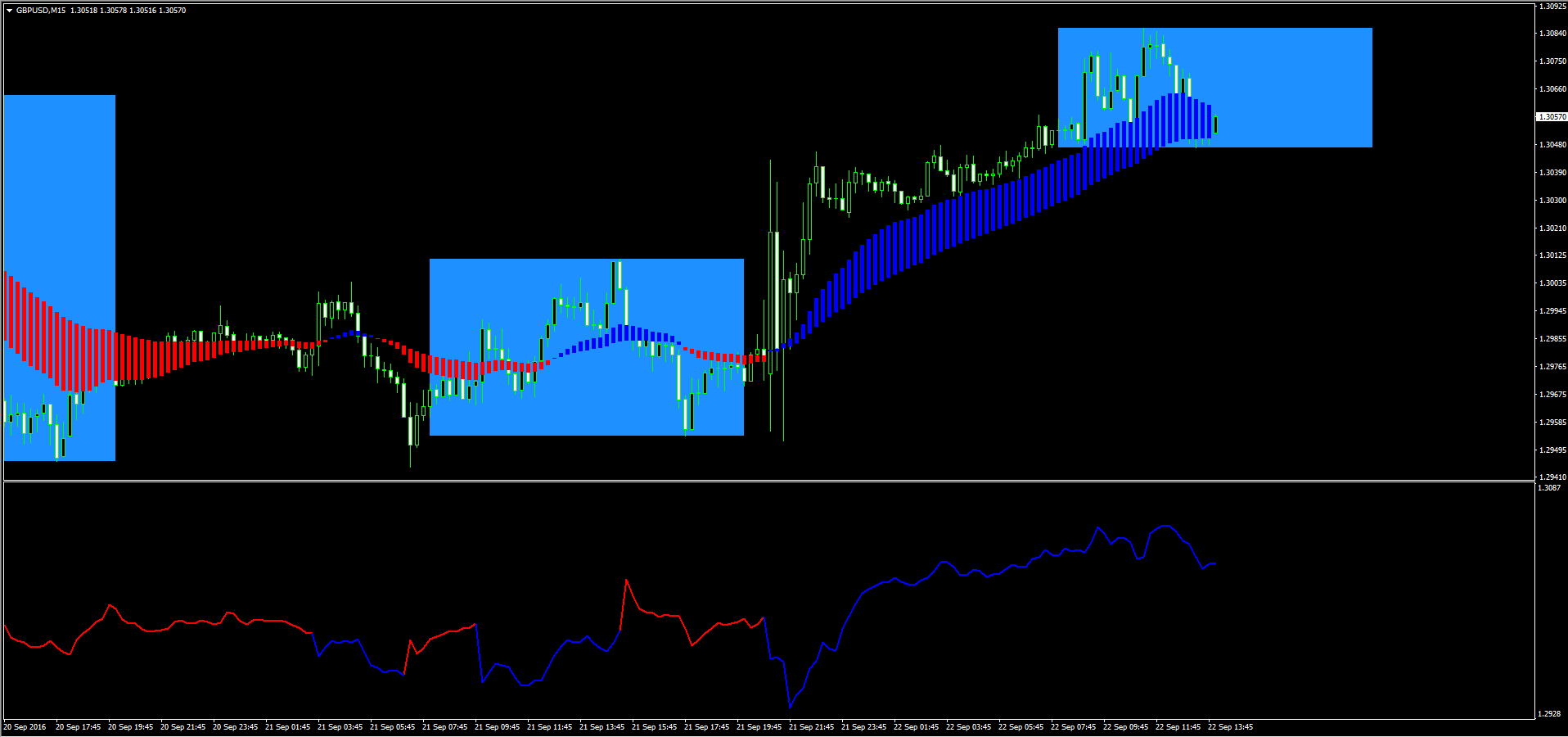

GBP/USD keeps the bearish outlook unchanged - UOB

The research team at UOB Group noted the bearish outlook still persist around GBP/USD. ?The major support highlighted at 1.2930 was not threatened as GBP rebounded strongly from a low of 1.2954. A temporary bottom is likely in place and the current corrective recovery appears incomplete. From here, allow for a dip to 1.3000 but 1.2950 is expected to hold for a stronger rebound to 1.3080?. ?Shorter-term momentum is waning rapidly and this coupled with oversold conditions has increased the risk of a short term low. Those who are short from last week (see FX Insight on 14/9/16, spot at 1.3195) should consider taking partial profit at current level. In the meanwhile, stop-loss remains unchanged at 1.3120?.

USD/CAD inter-market: More downside in play ahead of Canadian CPI

USD/CAD is on a declining trend so far this week, largely on the back of ongoing bullish momentum in oil prices, which has a positive impact on the Canadian dollar. Canada is highly dependent on oil exports for its revenues.The selling pressure behind the USD/CAD pair accelerated yesterday, after the US dollar weakened across the board on Fed?s inaction. The US central bank adopted a more cautious approach on its rate hike trajectory, in wake of persisting slack in the labor markets and lower price pressures. Further, oil price-rally gained traction after the US EIA inventory report showed an unexpected drawdown in the crude reserves, while supply disruption concerns on the back of a labor strike in Norway also underpinned the black gold, thus, eventually pushing CAD higher.Besides these fundamentals, various intrinsics such as the yield differential between the 10-year treasuries yields and its Canadian counterpart has turned in favor of the CAD, contributing to the move lower in the major today.Focus now shifts towards the Canadian economic releases due tomorrow, including the CPI and retail sales figures, which will provide fresh direction on the CAD pair. In the meantime, the USD dynamics and oil price-action will continue to drive the USD/CAD moves.

Gold consolidates before resuming its upward trajectory

Wednesday's decision by the Fed to leave interest-rates unchanged provided the required momentum for Gold to climb for the third consecutive session to a 2-week high level of $1337. Although the outcome was on expected lines, it exerted intense selling pressure around the greenback, as depicted by a sharp slide in the USD/JPY major, and boosted demand for dollar-denominated commodities - like gold. The accompanying rate-statement and economic projections did point to likelihood of a rate-hike before the end of this year but markets seems to have ruled out possibilities of a move in November, given the proximity of US election to the Fed's next policy meeting. The expectations were reaffirmed by a steep decline in the longer-term (30-years) US Treasury bond yields. Moreover, continuous drop in the Volatility Index (VIX) was seen supportive for risk-on rally across the board, lifting the broader US equity index (S&P 500) and provided an additional leg of up-move for the yellow metal.As the dust settled, a tepid recovery bounce in the USD/JPY major capped further up-move and has confined the precious metal within a narrow trading range around $1335 region. The current range-bound trading action could be categorized as a consolidation phase before the next leg of movement. With VIX, 30-year Treasury bond yields and up-tick in S&P 500 already supporting further up-move, renewed selling pressure around the USD/JPY pair is likely to trigger a fresh leg of appreciating move for the metal possibly towards its next major resistance near $1350 region.

FOMC Another step towards a December hike - SocGen

Omair Sharif, Research Analyst at Societe Generale, suggests that the outcome of the September FOMC meeting was in line with their expectations, as the Committee reintroduced the balance of risks statement, removed a rate hike this year and in 2017, and cut the longer-run nominal neutral funds rate.?In our view, the reintroduction of the balance of the risks statement was a way to bridge the divide between the hawks and doves on the Committee, and it took the Fed a step further towards raising the funds rate in December.With respect to assessment of current economic conditions, the statement was relatively bullish despite the recent weakness in both ISM surveys, and a tepid retail sales figure for August. The labor market was described in rosy terms, with the statement noting that ?the labor market has continued to strengthen...? and that job gains ?have been solid, on average.? Yellen herself noted in the opening remarks to her press conference that payrolls averaged about 180,000 the last four months, a pace that she said was ?well above the pace that we estimate is needed to provide work for new entrants into the job market.?

RBNZ on hold, but further easing required - Nomura

Research Team at Nomura, notes that as per their expectations, the RBNZ left its policy rate on hold at 2.00% while keeping its easing bias, noting that its ?current projections and assumptions indicate that that further policy easing will be required to ensure that future inflation settles near the middle of the target range.??It also expressed the view that NZD needs to depreciate, as it has had a negative impact on exports and inflation. Overall, nothing in this meeting changes our fundamental view that the RBNZ is likely to cut its policy rate at the November.Once again, the RBNZ communicated a weak outlook on the external front, highlighting that global growth continues to evolve below trend despite being supported by unprecedented levels of monetary stimulus. Consistent with its comments last month, it reiterated that global political uncertainty remained and that ?the prospects for global growth and commodity prices remain uncertain.?On the domestic economy, the Bank continues to point toward the elevated level of the currency, which may be culminating as a result of ?weak global conditions and low interest rates relative to New Zealand.? Although the Bank highlighted that 2Q GDP results were in line with its expectations and domestic growth remains supported by strong net immigration, construction activity, tourism, and accommodative monetary policy, the outlook for dairy prices remains uncertain, despite having firmed since early August.The RBNZ reiterated its concerns about excessive house price pressures, although ?the recent macro-prudential measures and tighter credit conditions in recent weeks are having a moderate influence.? We continue to believe that the introduction of these new measures affords the Bank more leeway in seriously considering more rate cuts before year-end to respond to adverse pressures in other sectors of the economy. The central bank expects inflation to rise starting in the December on the back of the base effect coming from energy prices. However, it remains concerned that current low inflation could feed into long-term inflation expectations.As expected, the Bank continues to sound concerned around the strength of the NZD, as it continues to pressure the export- and import-competing sectors and causing deflationary pressures in the tradable sector. Very explicitly, the Bank noted that ?a decline in the exchange rate is needed.?Overall, we think the meeting provides little new information and, thus, retain our forecast of a 25bps rate cut in November.?