EUR/USD testing lows near 1.1130/20, FOMC

The shared currency is losing further ground vs. its American peer today, with EUR/USD coming down to test daily lows in the 1.1130/20 band. EUR/USD breaks below 200-day sma. The pair has rapidly come under renewed selling pressure after announcements by the BoJ at today?s meeting have boosted the demand for the greenback in detriment of the safe haven JPY. Spot has broken below the critical 200-day sma at 1.1150 today, opening the door for a deeper pullback ahead of the key FOMC meeting due later in the NA session. Market participants expect the Committee to leave its monetary stance unchanged at today?s meeting, although investors will closely follow the subsequent press conference by Chair J.Yellen in order to find clues on the potential moves by the Fed in the next months. The pair is now down 0.13% at 1.1136 and a breakdown of 1.1121 (low Aug.31) en would target 1.1043 (low Aug.5) en route to 1.0950 (low Jul.25). On the flip side, the immediate resistance is located at 1.1216 (high Sep.20) followed by 1.1283 (resistance line off 2016 high) and finally 1.1329 (high Sep.8).

GBP/USD attempts tepid-bounce from 5-week lows, Fed

The GBP/USD pair is seen trimming losses, after having slumped to fresh five-week lows below the mid-point of 1.29 handle in late-Asia. Currently, GBP/USD drops -0.11% to 1.2975, retreating slightly from multi-week troughs struck at 1.2946 following BOJ?s announcement. The major slid sharply after the US dollar picked-up significant strength in tandem with the USD/JPY pair, following new policy framework introduced by the BOJ, while leaving rates unchanged today. Meanwhile, the USD index trades +0.23% higher at 96.19, easing-off six-week tops printed at 96.29 levels. Next in focus remains the BOJ presser, with Kuroda likely to bring in additional volatility, while the Fed policy decision takes center-stage today amid limited macro data from the UK docket. The pair has an immediate resistance at 1.3001 (5-DMA), above which 1.3089/93 (Aug 17 & Sept 19 high) would be tested.

USD/CHF making a fresh attempt to conquer 200-DMA

The USD/CHF pair is seen building on to its move back above 0.9800 handle and make a fresh attempt to break through the very important 200-day SMA. Currently trading at session high around 0.9815 region, the pair is benefitting from a broad based US Dollar buying interest, primarily led by its strength against the Japanese Yen on the back of BOJ announcement. Although the Bank of Japan left its benchmark rates unchanged at -0.1%, its commitment to continue with aggressive monetary easing in order to achieve 2% inflation target in a promised two-year time frame lifted the greenback sharply higher and the spillover effect provided a boost to the USD/CHF major. However, the pair's near-term trajectory would be determined by the Federal Reserve monetary policy decision, scheduled to be announced later during NY trading session on Wednesday. The central bank is not expected to move this time, but a hawkish commentary would leave doors open for at least one rate-hike during 2016 and might eventually continue driving the greenback higher. A follow through buying interest above weekly high resistance near 0.9819 is likely to boost the pair immediately towards 0.9835 intermediate resistance before the pair eventually rises to monthly high resistance near 0.9885 level. On the flip side, sustained weakness back below 0.9800 handle could possibly drag the pair back towards retesting 0.9760-55 confluence support, comprising of 50-day and 100-day SMAs below which the pair might turn vulnerable to correct further in the near-term.

GBP/JPY keeps session highs near 133.20

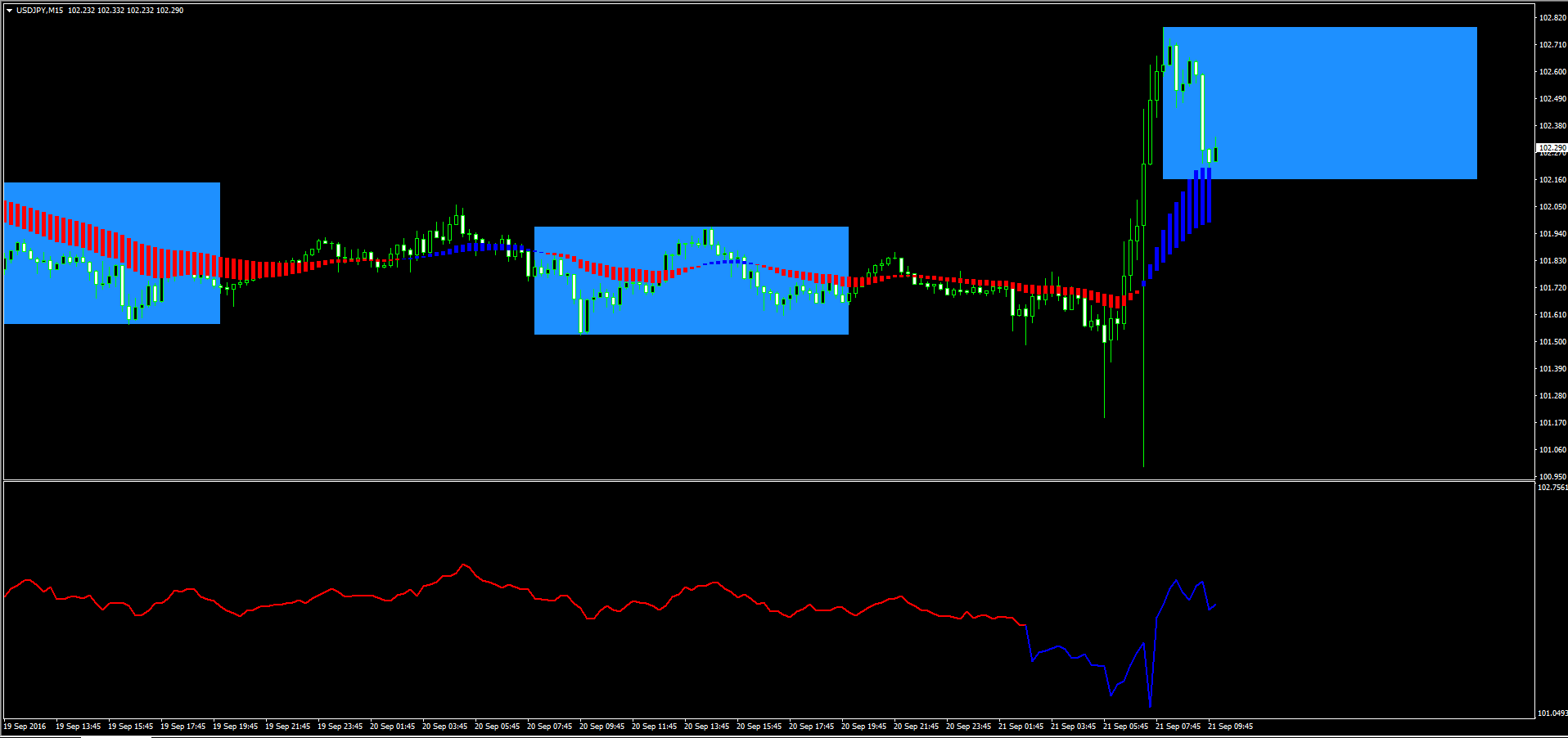

The offered tone around the Japanese currency has lifted GBP/JPY to daily tops in the 133.20 area today, following the BoJ meeting. The cross has quickly climbed to 2-day tops above the 133.00 handle as market participants have perceived the BoJ meeting as dovish, sparking a wave of selling interest around the Japanese currency. In fact, the BoJ left its benchmark rate unchanged, abandoning at the same time the ?monetary base target? and advocating for a control of the yield curve. The initial reaction in global markets has been a sell off in JPY and a sharp climb in Japanese stocks, although the extent of the move remains to be seen. As the moment the cross is gaining 0.76% at 133.12 and a break above 134.96 (55-day sma) would expose 135.08 (20-dat sma) and finally 136.19 (23.6% Fibo of post-Brexit down move). On the other hand, the initial support lines up at 129.19 (low Aug.16) followed by 128.77 (2016 low Jul.6) and then 118.70 (low Jun.1 2012).

Gold turns lower after BOJ, eyeing Fed for a firm near-term direction

In a knee-jerk reaction to BOJ monetary policy decision, Gold reversed sharply from a 5-day high and dropped to $1308 but held its near-term trading range and has now stabilized around $1311-12 area. At its latest monetary policy meeting, Bank of Japan left rates unchanged at -0.1% and kept monetary policy base unchanged at 80 trillion Yen. The market initially seemed disappointed as the expectations were pointing that the central bank would take interest rates farther into negative territory and announce additional monetary stimulus measures. After an immediate bullish spike, the Japanese Yen quickly reversed all of its strength and tumbled across the board, boosting demand for the greenback and eventually capped any recovery for the precious metal. Hence, focus would remain on the Fed monetary policy decision, scheduled to be announced later during NY trading session on Wednesday, which would help investors determine the near-term trajectory of the greenback and trigger the next leg of direction move for dollar-denominated commodities - like gold. Technical levels to watchOn a sustained weakness below $1310 level, the commodity seems to immediately head towards testing 100-day SMA support near $1305, which if broken would open room for further near-term depreciating move. Meanwhile on the upside, a decisive strength above $1318-20 resistance area might negate near-term bearish bias and lift the metal back towards $1330 resistance area.